Portfolio companies

General

From an overarching perspective, it is Industrivärden’s expectation that its portfolio companies will:

- view sustainability as an important, strategic issue and conduct salient sustainability work within their respective sectors, with sustainability aspects integrated into their business models, business cultures, strategies, processes and product offerings;

- continuously develop and strengthen their sustainability work in a structured way with support from relevant guidelines and measurable goals;

- monitor, evaluate and continuously communicate the progress of their sustainability work and convey the ways in which they contribute to long-term sustainable development in the communities in which they operate.

A number of goals have been formulated to drive the development on Industrivärden’s sustainability-related focus areas as an owner.

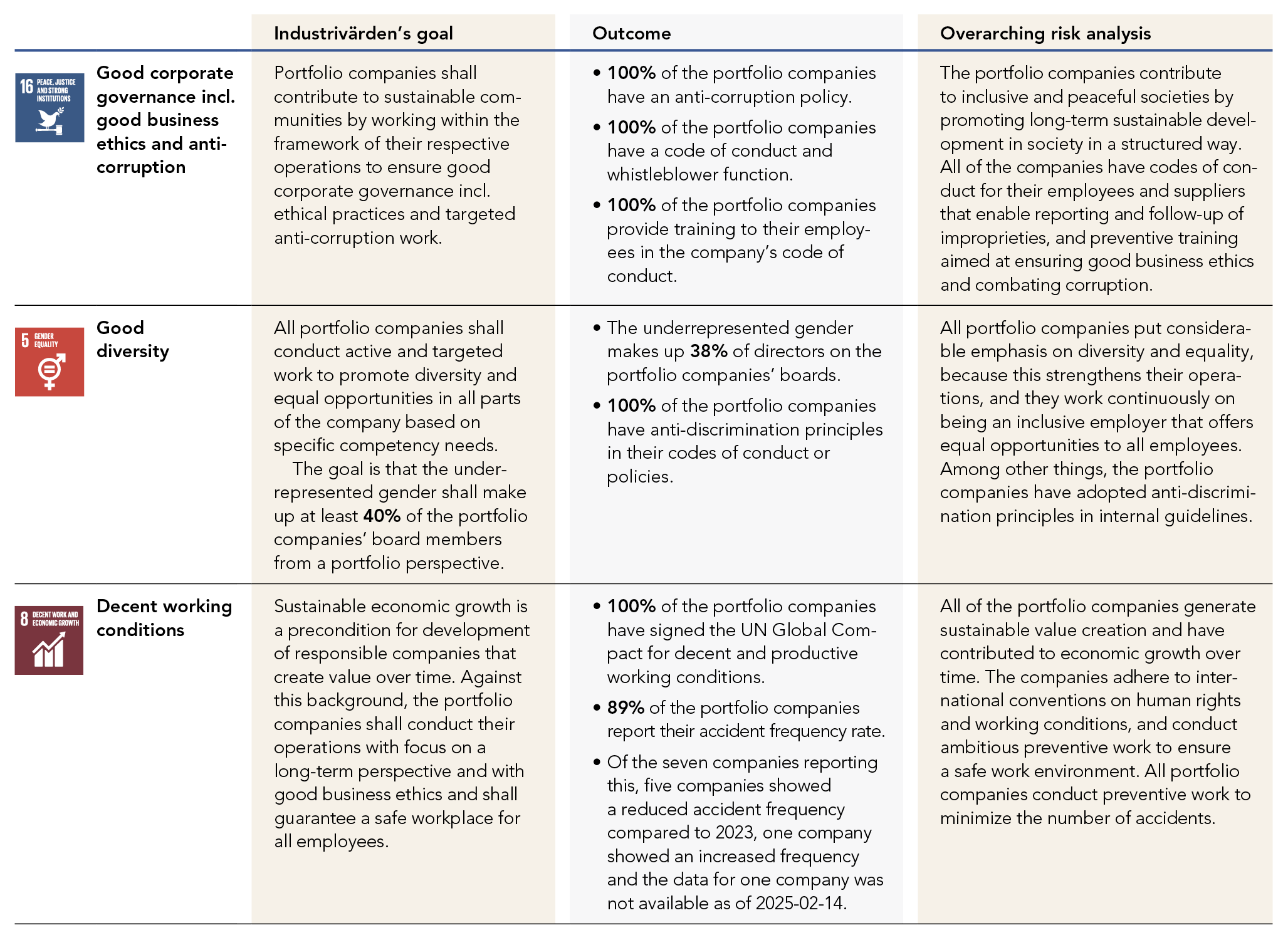

1. Responsible corporate governance and a sustainable role in society

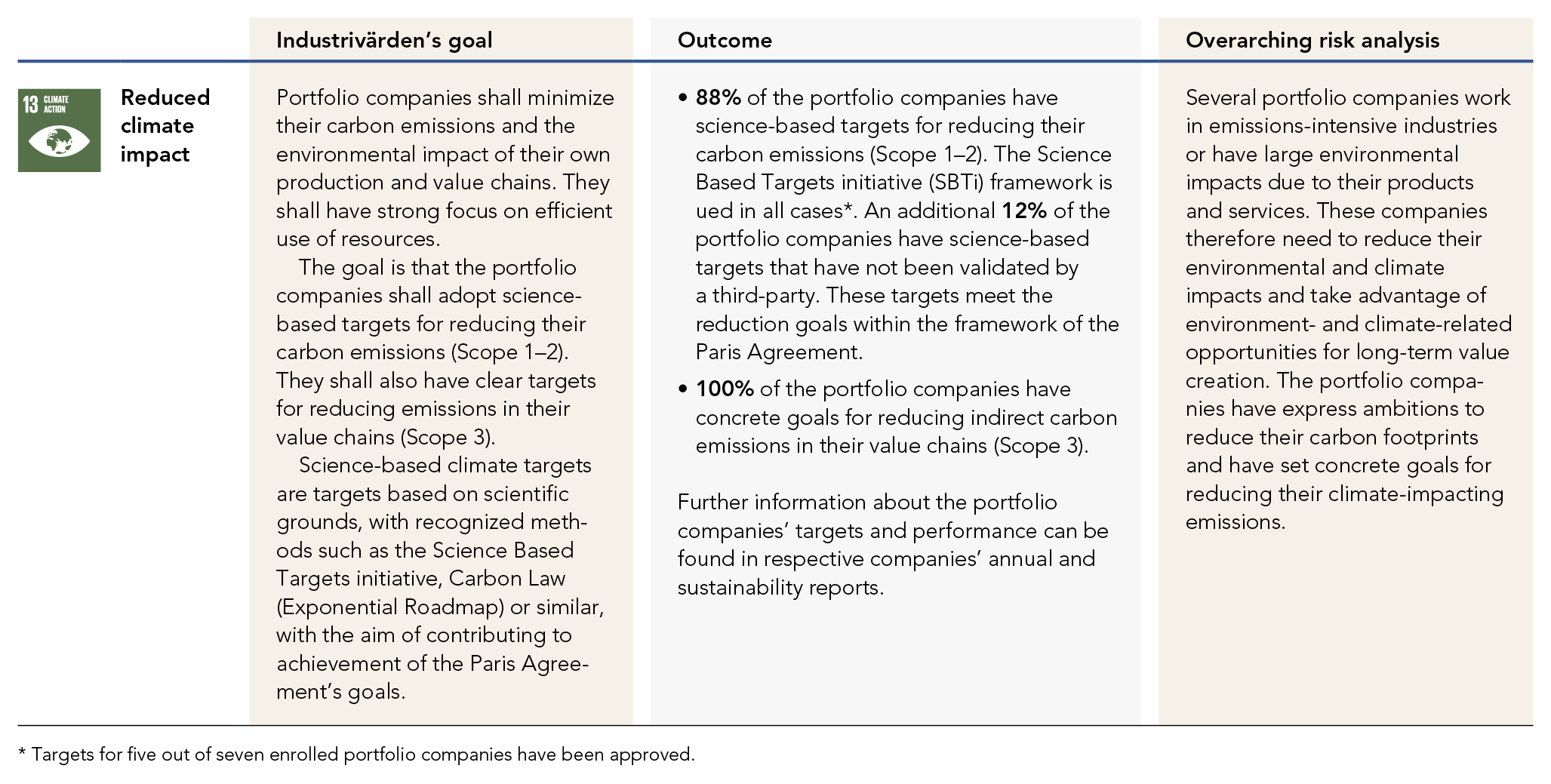

2. Minimized negative climate and environmental impact

Management of climate-related risks and opportunities

Long-term value creation requires reduced climate impact and successful utilization of climate-related opportunities. Industrivärden’s greatest climate risk consists of the combined climate risk in the equities portfolio based on Industrivärden’s share of ownership in the portfolio companies, which is described below.

Through its active ownership Industrivärden follows the respective portfolio companies’ analysis, emissions reduction measures and climate-related opportunities. The portfolio companies are active in different sectors and geographies, and thus their climate risks differ. Industrivärden’s respective sustainability analyses are therefore based on the portfolio companies’ climate scenario analyses, internal and external expert knowledge, and measures taken by the companies.

Industrivärden’s governance, strategy and management of climate risk are conducted in line with the model for sustainability issues that is described above in this sustainability report. Where needed, influence is exercised in accordance with Industrivärden’s ownership model.

The portfolio’s carbon emissions

The largest share of Industrivärden’s emissions consist of indirect carbon emissions within framework of the Company’s ownership in the portfolio companies (Industrivärden’s Scope 3 emissions). Greenhouse gas emissions (CO2e) from the equities portfolio and Industrivärden’s own operations have been reported since 2010, when Industrivärden also began reporting its carbon footprint to the CDP (cdp.net).

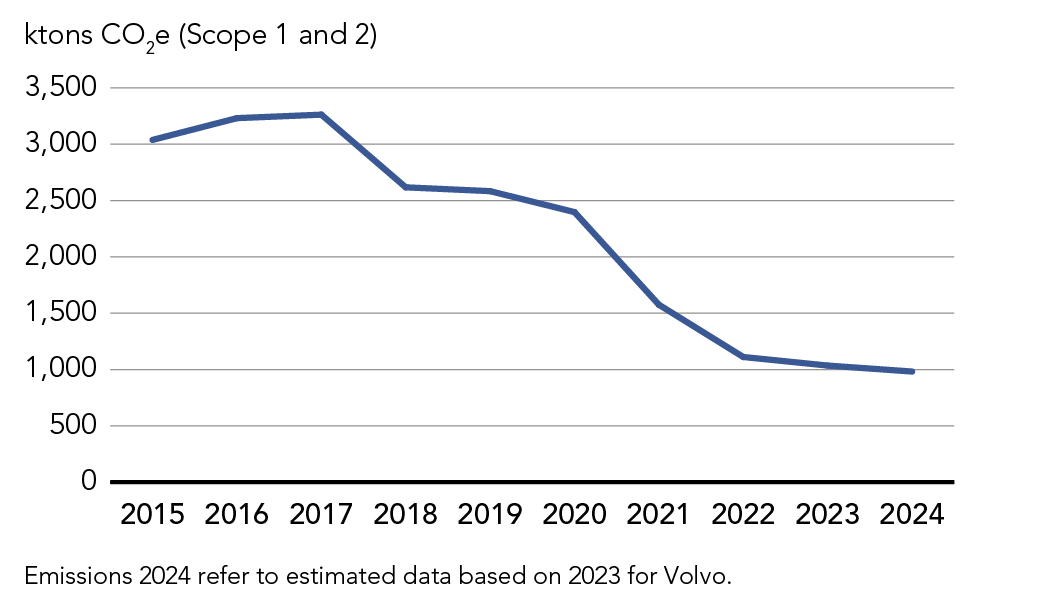

The chart below shows the portfolio’s yearly emissions (portfolio companies’ Scope 1 and 2) over the past ten years. Data has been obtained from the portfolio companies’ own disclosures of greenhouse gas emissions (GHG Protocol, market-based method), in proportion to Industrivärden’s share of ownership (equity share approach). This development illustrates the portfolio companies’ determination to steadily reduce their CO2e emissions as well as Industrivärden’s divestment of its holding in steel company SSAB in 2020/2021 and its holding in ICA Gruppen in 2018/2019.

Portfolio emissions

The equities portfolio’s climate exposure

The largest share of Industrivärden’s climate risk exposure is within the framework of its ownership in the portfolio companies. Industrivärden uses the companies’ climate scenario analyses and TCFD reporting, among other things, as documentation for its analysis of their identification and management of climate risk. Given that the portfolio companies are active in varying business areas, their analyses differ, but from a portfolio perspective a number of more general risks can be described, as below. The compilation shows the portfolio companies’ disclosed climate-related risks in terms of physical risks and transition risks that could potentially impact the companies’ operations in the short, medium, and long terms. Climate-related opportunities pertain to the companies’ identified ability to create value added that contributes to growth, emission reductions and societal benefit.

Physical risks

- Disruptions caused by extreme weather events – impacts in supply chains, on transports, own production and property holdings (acute risk)

- Permanent changes to the climate and environment – higher average temperatures, rising sea levels and changed precipitation patterns – higher costs for climate adaptation measures, impact on asset values (chronic risk)

- Shortages/depletion of critical raw materials (chronic risk)

Transition risks

- Higher costs due to imposition of carbon emissions regulations and taxes (policy and regulatory risk)

- Higher reporting and compliance costs (policy and regulatory risk)

- Operational limitations for companies due to ownership rights/use regulations (policy and regulatory risk)

- Slow and/or unpredictable approval processes (policy and regulatory risk)

- Inability to develop the products, solutions and offerings needed for transition to a low-emissions economy – adaptation and limitation of impact (technological risk)

- Supply and pricing of renewable energy, raw materials, water and transport (market risk)

- Changed preferences and behaviors among customers (market risk)

- Inability to fulfill requirements and expectations of company stakeholders (reputational risk)

Opportunities

- Innovation and technological development of products, services and offerings that support the transition to a low-emissions society

- New business models and effective sustainability work result in competitive advantages, customer satisfaction and investment capital

- Products that support emissions reductions among customers and partners

- Global operations reduce geographic risks

- Longer growing seasons result in faster/larger harvests

- Own production of renewable energy is profitable

- Cooperation and partnerships with research, trade organizations and local communities

Industrivärden has reported climate-related information to the CDP since 2010. TCFD recommendations are now integrated into the CDP’s questionnaire on climate change. Industrivärden has implemented relevant parts of the TCFD’s recommendations regarding its own operations since 2020.

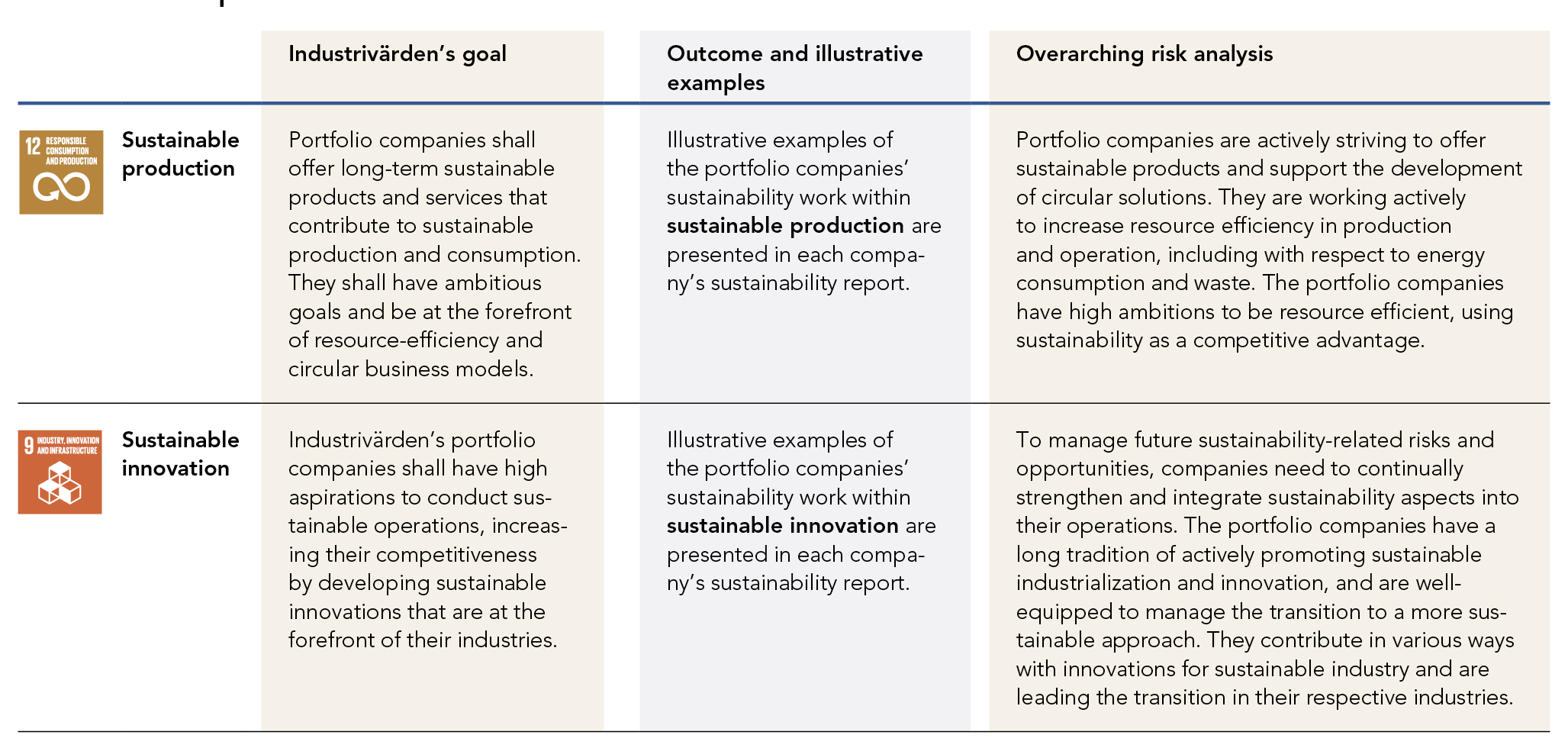

3. Sustainable production and innovation