Share development

Industrivärden’s Class A and C shares are listed on the Stockholm Stock Exchange (Nasdaq Stockholm), Large Cap segment.

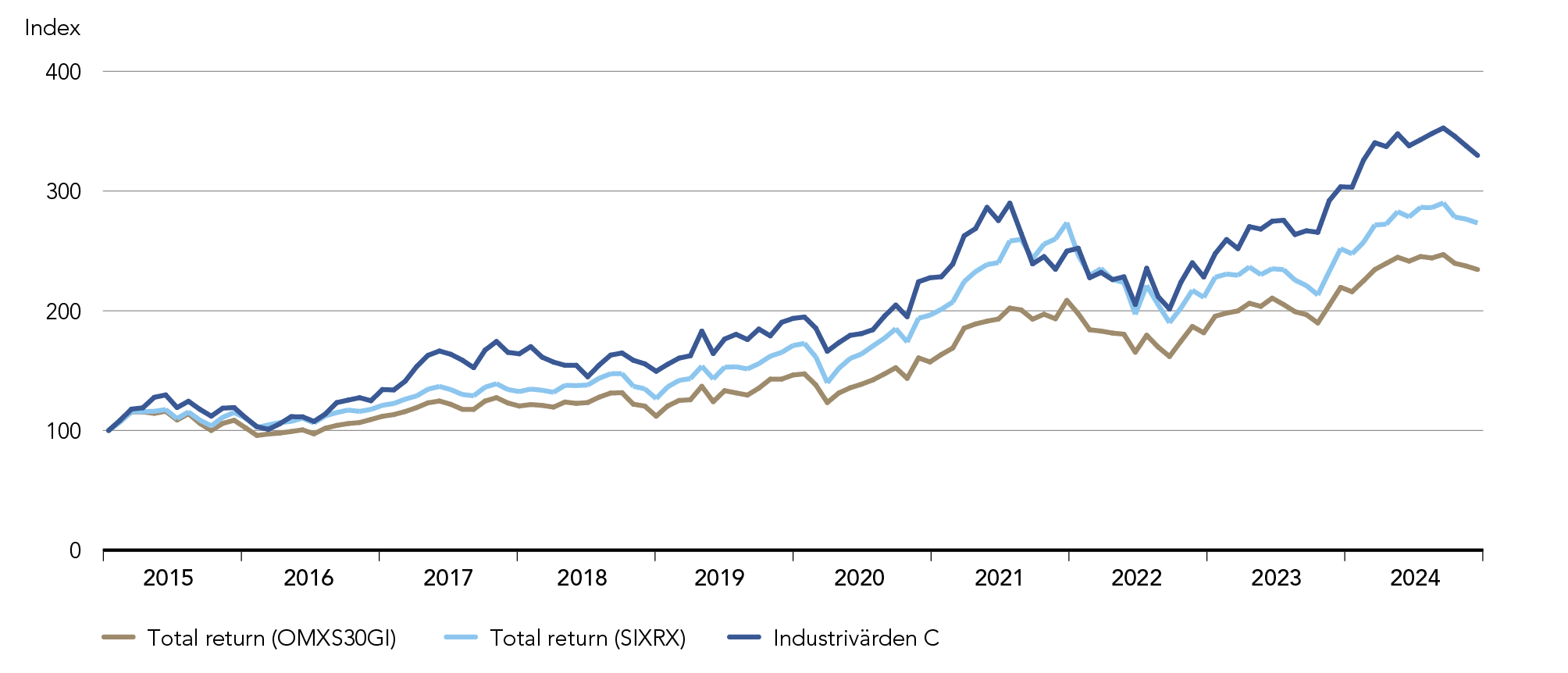

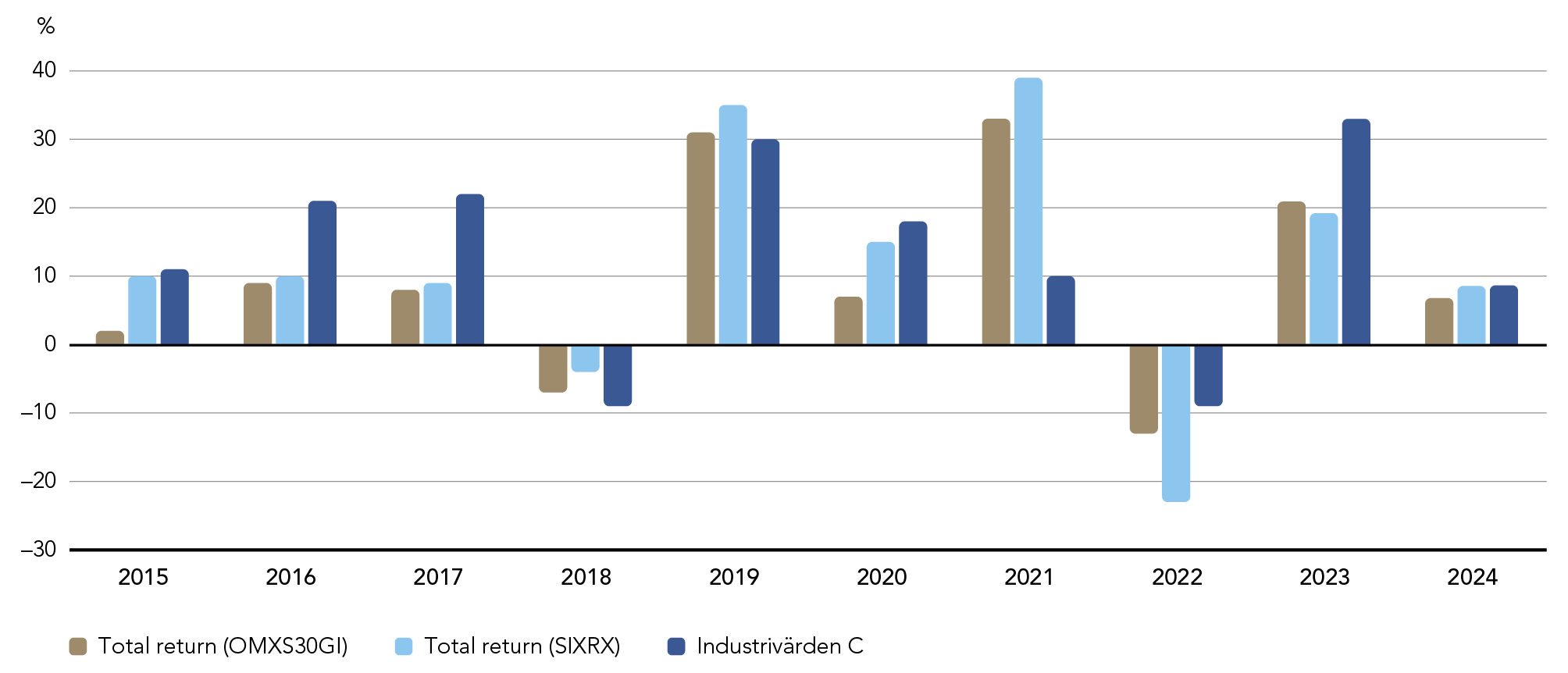

During the last ten-year period the average annual total return was 12% for Industrivärden’s Class A shares and 13% for the Class C shares, compared with a total return of 11% for the Stockholm Stock Exchange (SIXRX) and a total return of 9% for OMXS30 (OMXS30GI).

Total return over time

Total return per calendar year

- Exposure to a number of leading listed companies characterized by strong market positions, good cashflows, financial strength and clear capacity for development

- Strong position of influence and active ownership through board and nomination committee representation

- Professional and well-adapted organization with proven track record of long-term value creation