Financing

Industrivärden has a strong financial position, which provides good flexibility to seize investment opportunities and act over time.

Organization

Industrivärden’s financing and management of financial risks are conducted in accordance with guidelines set by the Board of Directors. Industrivärden’s finance function works primarily with financing and investment of temporary surplus liquidity.

Financing

Industrivärden’s financing is arranged through both short and long term borrowing. The credit facilities give Industrivärden the ability to act on attractive investment opportunities at short notice. No part of the financing is conditional upon any covenants.

Net debt

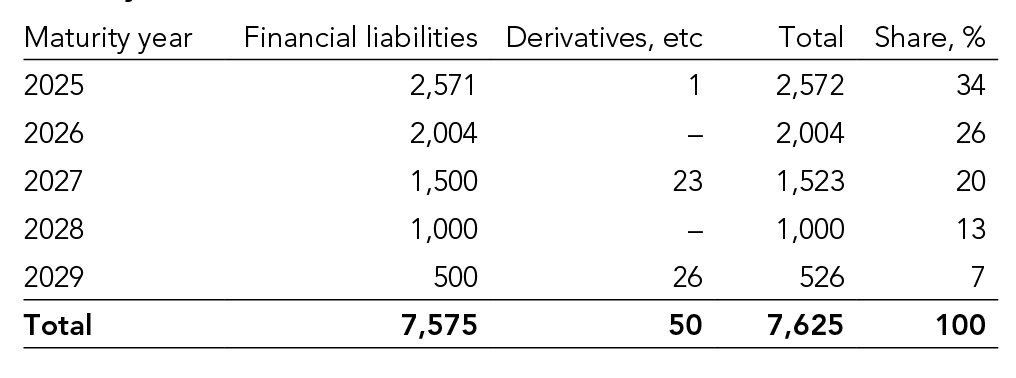

Maturity structure