Active ownership

Value creation through active ownership

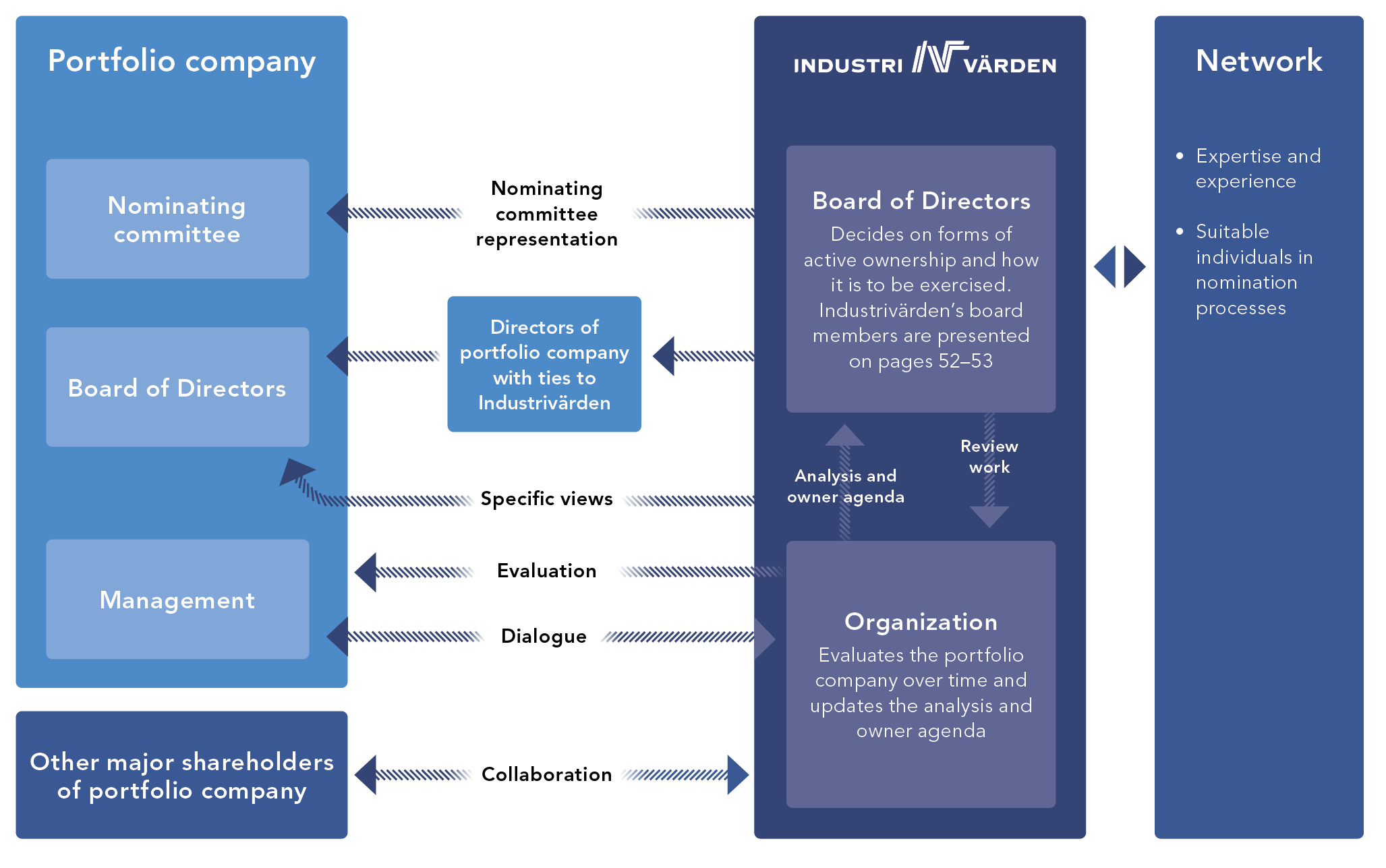

Industrivärden is an engaged and responsible owner that provides support, makes clear demands and has a clear owner agenda. The ownership role is based on having significant influence, industrial knowledge, a long-term perspective and financial strength. In Industrivärden, the portfolio companies have an owner that actively participates in their corporate governance and strategic development. With its long-term perspective, Industrivärden can support and get behind initiatives in the portfolio companies that entail investment today, but that generate substantial value in the longer term.

The formulation and execution of the portfolio companies’ strategies are of major importance for their long-term success. In this respect, Industrivärden puts particular emphasis on a number of fundamental principles: proper board composition and distinct leadership in the portfolio companies, strategic focus, decentralization, operational flexibility and efficiency, financial strength and a sustainable approach. These qualities strengthen the companies’ ability to conduct and develop their operations effectively. At the same time, they increase the companies’ flexibility to quickly respond to market fluctuations, changed customer demands and the broader geopolitical situation. This is especially important at times of major change, when companies need to take advantage of opportunities and reduce risks coupled to digitalization, electrification and sustainability, for example. Industrivärden’s fundamental view is that the respective portfolio companies will continuously develop their businesses based on their respective circumstances.

Analysis and owner agenda

Industrivärden continuously evaluates the portfolio companies’ respective businesses and operating environments. This work is performed by company teams that are led by a team manager, and employees are normally active on two to three teams. Key areas of evaluation include strategy, market position, business composition, financial development and capital structure, among others. Analysis is conducted with a broad perspective and encompasses everything from customers, competitors and markets to salient megatrends such as digitalization, new technologies and long-term sustainable development. A keen understanding of these shifts is of major importance for the ability to assess the portfolio companies’ long-term value potential as well as the opportunities and challenges they face. In this way, Industrivärden builds up a depth of fact-based knowledge about the respective portfolio companies and their business environments. Based on this knowledge, an owner agenda for value creation is continuously updated, which summarizes the strategic value drivers that are considered to be most important for value creation during the coming three to five years. The aim is to identify and describe various opportunities for value growth and strategic measures for realizing this value.

Nominating committee work

The portfolio companies’ boards play a decisive role in the companies’ governance and the appointment of the right CEO. A suitably composed board is crucial. The portfolio companies’ boards must have the combined expertise and experience required to deal with the respective companies’ challenges and opportunities over time. Industrivärden therefore actively participates in the portfolio companies’ nomination processes, where its representatives in the nominating committees consist of individuals from Industri- värden’s board and executive management. Since access to qualified board members is a key success factor, Industrivärden works actively to identify suitable individuals. The portfolio companies conduct business in a wide range of areas, and therefore Industrivärden continuously maintains a broad network of individuals with expertise and experience in a range of different areas.

Board representation

The individuals on Industrivärden’s Board and members of the Executive Management who also serve as directors on portfolio companies’ boards are considered to have ties to Industrivärden. The owner agendas for the respective portfolio companies are presented on a continuous basis to Industrivärden’s Board of Directors. In addition, the portfolio companies’ CEOs make business presentations to Industrivärden’s Board on a regular basis. In this way the Board of Directors receives a current and accurate picture of the portfolio companies along with identified measures for value creation. With a starting point in well-researched analyses, Industrivärden can gain a hearing for its views and contribute to companies’ development.

Through its engagement and long-term presence, Industrivärden establishes close relationships with the portfolio companies’ management teams, board members and board chairs.

Continuous dialogue

On top of its work on the portfolio companies’ nominating committees and boards, Industrivärden is engaged in a continuous dialogue with the companies on a number of important matters, such as strategy, market position, financial development, etc. In addition, Industrivärden presents parts of its owner agendas for the portfolio companies’ CEOs and other senior executives. Industrivärden also attaches great importance to visiting the portfolio companies’ various operations.

Well-suited organization and extensive network

Based on its chosen strategy, Industrivärden conducts its business activities in an efficient organization characterized by high flexibility and short decision-making channels. Industrivärden has approximately 15 employees, most of whom are active in the investment organization. The organization encompasses a strong base of expertise about the portfolio companies and their respective industries as well as the business environments they work in. In addition, Industrivärden has nine board members and an extensive network.

Industrivärden works in a structured manner to maintain and develop a network of individuals to support the company’s business model in various ways. This may involve identifying potential candidates to support the work of portfolio company nomination committees or skills that contribute to Industrivärden’s continuous company analysis.