Ownership and development

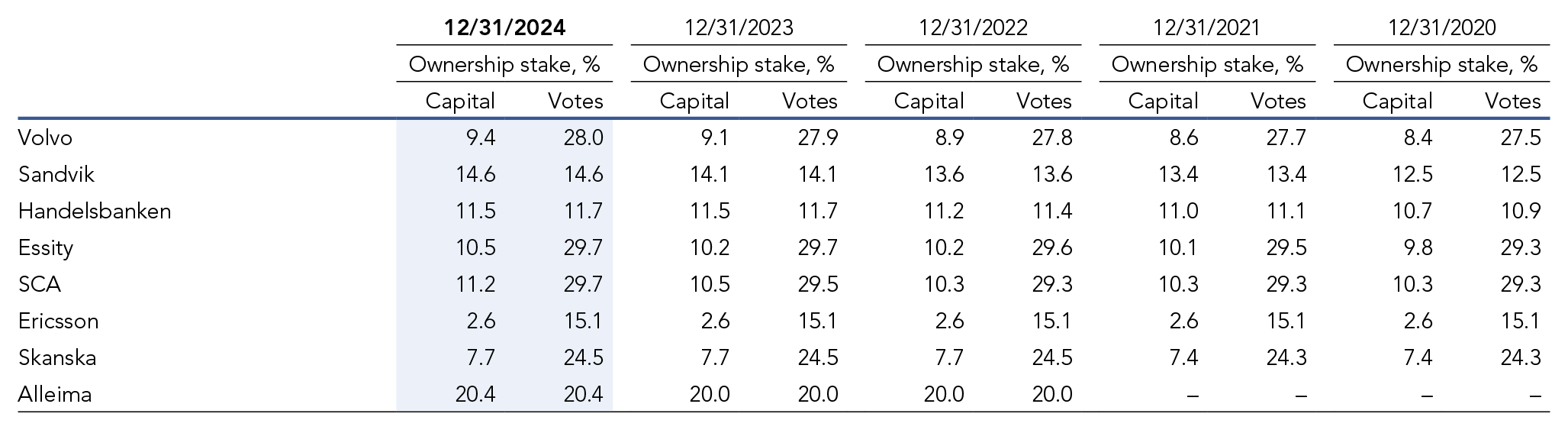

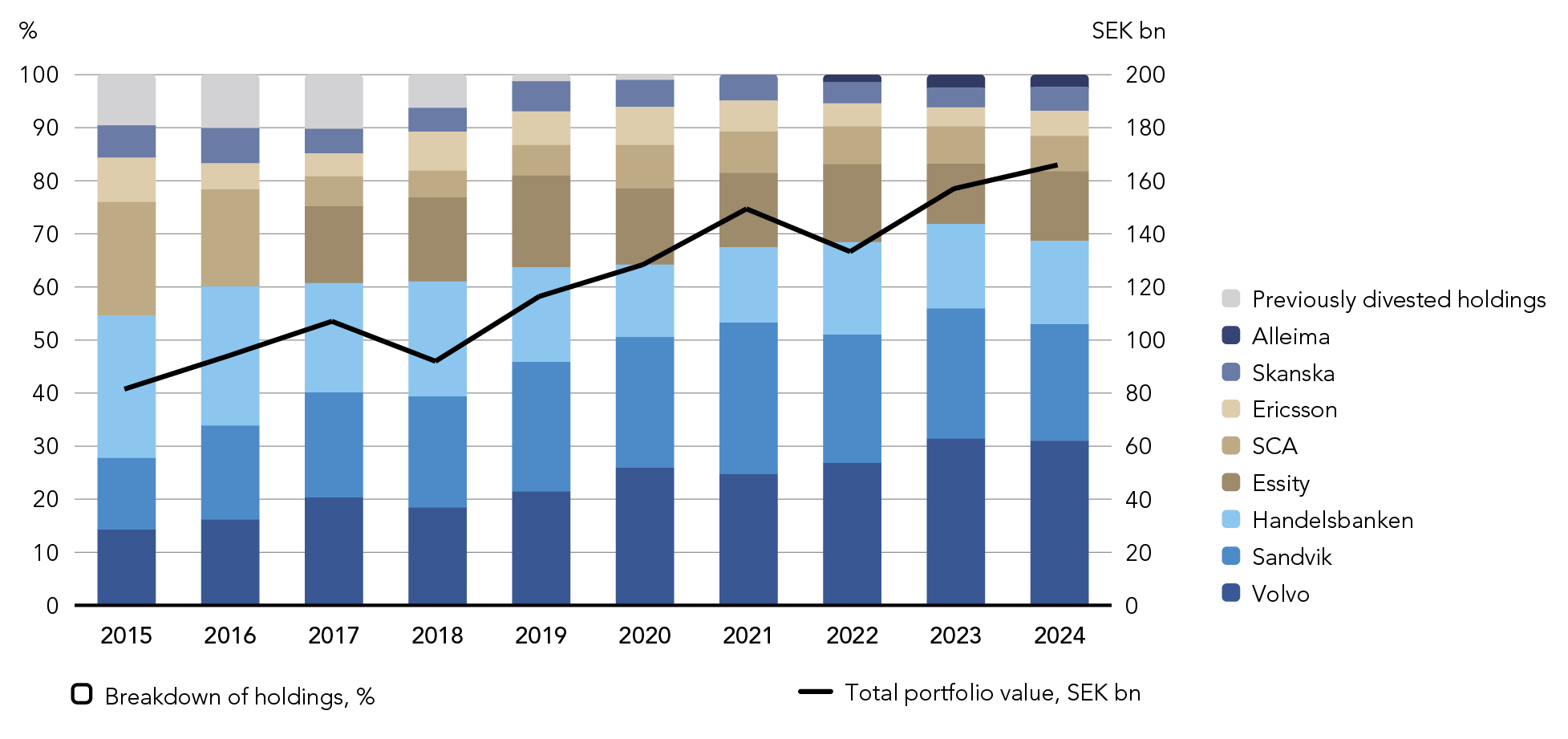

Industrivärden has sizable ownership stakes in eight portfolio companies: Volvo, Sandvik, Handelsbanken, Essity, SCA, Ericsson, Skanska and Alleima.

The portfolio companies are characterized by proven business models and long-term value potential. In exercising its active ownership, Industrivärden works according to the portfolio companies’ respective conditions, but attaches particular importance to a number of principles that increase opportunities for value creation and reduce risk over time.

Overall, the portfolio companies provide broad exposure to business areas and geographies. The companies are active in a range of different areas including commercial vehicles, industrial equipment, banking, consumer products, forestry and forest products, telecommunications, construction and materials technology. Within the framework of these respective core businesses, the companies also have a number of free-standing business areas with their own profit responsibility. This broad base of exposure increases opportunities for value creation and lowers risk.

Through its active ownership, Industrivärden contributes to the portfolio companies’ development, enhanced profit generation and value growth over time.

The holdings

Portfolio

| Andel % | Bolag |

|---|---|

| 33 % | Volvo |

| 23 % | Sandvik |

| 15 % | Handelsbanken |

| 12 % | Essity |

| 6 % | SCA |

| 4 % | Skanska |

| 4 % | Ericsson |

| 3 % | Alleima |

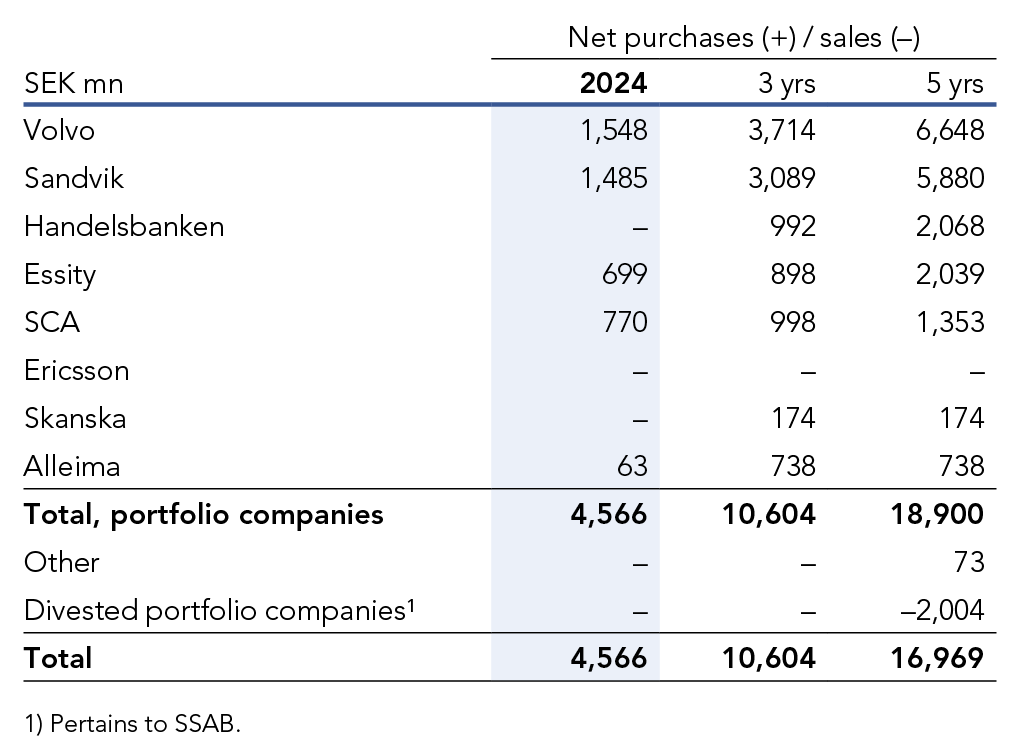

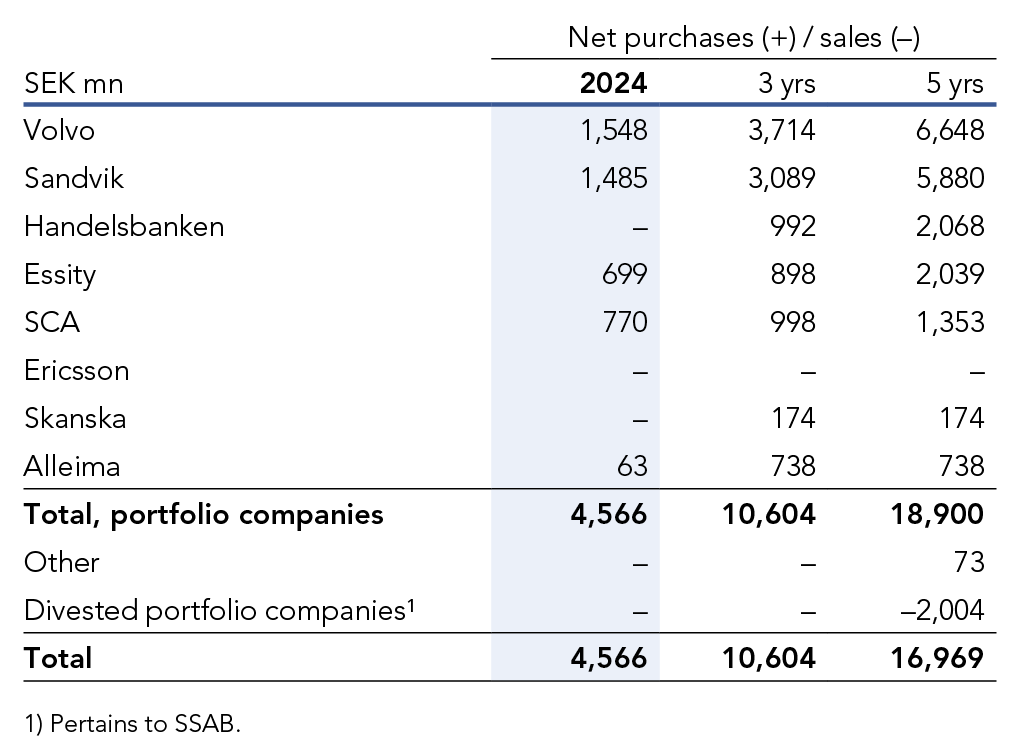

Investment activities

Investments are made continuously in order to strengthen ownership in the portfolio companies over time and thereby increase the financial exchange of Industrivärden’s active ownership.

Dividends received

Dividends received in 2024 amounted to SEK 8,585 mn (6,418). During the last five-year period, dividends received from portfolio companies totaled SEK 29,219 mn.

Investments

Dividends

Share of ownership over time

Breakdown of holdings

Portfolio companies’ financial value creation

Through active ownership, Industrivärden works long-term to develop and create value in its portfolio companies. Shareholder value generated in Industrivärden is based on the stock market’s valuation of the portfolio companies’ financial performance, dividend capacity, risk exposure and future prospects.

Industrivärden’s combined share of the portfolio companies’ profit generation capacity can be illustrated as the capital-weighted share of the portfolio companies’ operating profit. During the period 2018 through 2024, aggregated weighted operating profit has increased by an average of 11.2% annually, compared with 9.2% annually for Large Cap companies on the Stockholm Stock Exchange.

Correspondingly, the capital-weighted dividend yield of Industrivärden’s portfolio companies amounted to 5.7% on December 31, 2024, compared with 2.0% for Large Cap companies on the Stockholm exchange.

Industrivärden’s portfolio companies generally have a balanced range of gearing, which limits the associated risk. This can be illustrated in the form of the capital-weighted net debt as a percentage of operating profit before depreciation and amortization (EBITDA). The ratio amounts to 0.1x compared with 1.3x for Large Cap companies on the Stockholm exchange.

The stock market continuously measures the portfolio companies’ financial performance and future outlook, expressed in terms of the respective companies’ market capitalizations. During the last ten-year period, as of December 31, 2024, the aggregate market value of Industrivärden’s ownership stakes in the portfolio companies has increased by an average of 7% per year. During the corresponding period, net asset value has grown by an average of 9% per year.