Risk management

The types of financial risks that the Industrivärden Group encounters in its operations consist primarily of share price risk and – to a limited extent – other financial risks, such as interest rate risk and financing risk. Industrivärden’s financing and management of financial risks are conducted in accordance with guidelines set by the Board of Directors.

Share price risk

Share price risk is the dominant risk in Industrivärden’s operations and pertains to the risk of a decline in value caused by changes in prices in the stock market. A change in the price of all holdings of listed shares by one percentage point would have affected the portfolio’s value on December 31, 2024, by +/– SEK 1,700 mn (1,600).

Industrivärden’s role as a long-term, active owner should reduce the relative share price risk in the portfolio companies and thereby also in Industrivärden’s equities portfolio.

Interest rate risk

Interest rate risk is the risk that the financing cost will vary due to changes in market interest rates. Industrivärden’s financial instruments that are exposed to interest rate risk consist mainly of loans with variable interest rates. Interest rate risk can be mitigated by limiting the level of debt and taking into account fixed interest periods and the maturity structure of existing loans in connection with new borrowing. Interest rate risk can also be managed through swap agreements aimed at adjusting the terms for fixed interest periods and maturities. At year-end the majority of the Group’s debt ran with fixed interest rates. On December 31, 2024, the average fixed interest period was 17 months (21).

Based on net debt and the fixed interest periods at year-end, a change in the market interest rate by 1 percentage point would have affected income after financial items in 2024 by approximately +/– SEK 12 mn (21).

With low gearing, Industrivärden also has limited interest rate risk.

Financing risk

Financing risk is the risk that financing of the operations’ capital requirement at any given time will be impeded or more costly. Financing risk is reduced by maintaining an even maturity structure along with available credit frameworks and credit promises. Under a Medium-Term Note (MTN) program Industrivärden has the opportunity to issue bonds in SEK or EUR up to a framework amount of SEK 10,000 mn (10,000), of which SEK 7,000 mn (8,000) was utilized on December 31, 2024. In addition, under a commercial paper framework of SEK 4,000 mn (4,000), Industrivärden has utilized SEK 500 mn (0) on December 31, 2024.

Industrivärden’s net debt amounted to SEK 6,914 mn (7,295) on December 31, 2024. The average maturity, excluding pension provisions, was 20 months (25).

The credit rating agency S&P Global Ratings has assigned Industrivärden a long-term rating of A+/Stable outlook and short-term rating of A-1 and K-1, respectively.

Industrivärden has a strong financial position, with an equity ratio of 95% (95%). Combined with a strong rating, this means that the financing risk is considered to be very low and financial flexibility is considered to be good.

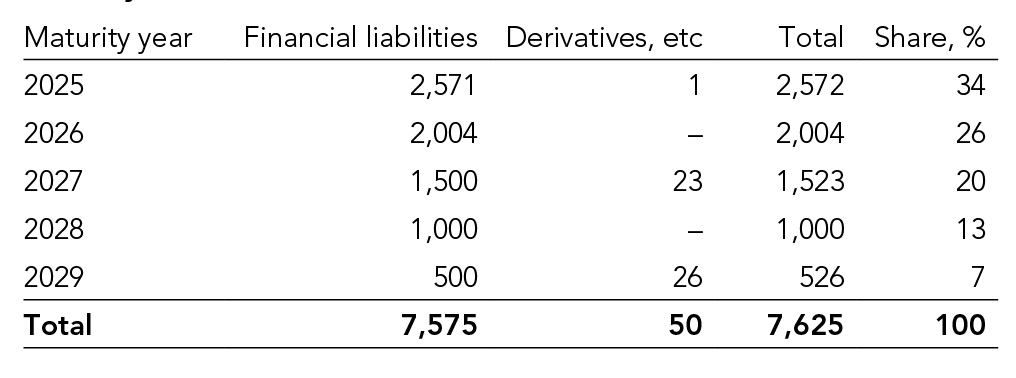

The maturity structure of undiscounted financial liabilities and derivative instruments with negative market values on December 31, 2024, is presented below:

Maturity structure

Liquidity risk

Liquidity risk is the risk of not being able to meet payment obligations due to insufficient liquidity. Industrivärden has exposure to liquidity risk in connection with the refinancing of loans and in the event a financial instrument cannot be sold without leading to considerably higher costs.

Liquidity risk can be mitigated by forecasting anticipated dividends from portfolio companies, limiting the maturities of short-term investments and ensuring that long- and short-term loan promises have been contracted. On December 31, 2024, Industrivärden had contracted long-term loan promises of SEK 4,000 mn (4,000) and short-term loan promises of SEK 500 mn (500) in the form of an overdraft facility.

Against the background of the measures outlined above, the Company’s strong financial position and liquid financial instruments, the liquidity risk is considered to be low.

Counterparty risk

Counterparty risk is the risk of a party in a transaction with a financial instrument not being able to meet its obligations and thereby causing loss to the other party.

Industrivärden’s internal rules and guidelines prescribe that approved counterparties have high credit ratings, which is why counterparty risk is considered to be low.

Internal control

Against the background of the share price risk described above, continuous monitoring of value exposure in the equities portfolio is the most important control process in Industrivärden’s business. Industrivärden’s internal control is therefore primarily focused on ensuring the reliability of valuations of outstanding equity and derivative positions and of the reporting of purchases and sales of shares and other securities. Industrivärden’s control environment is built upon a clear division of duties and responsibility, well-established governance documents and guidelines and a good company culture.