Share structure

Value and trading volume

Trading volume in Industrivärden shares on the Stockholm Stock Exchange in 2024 totaled SEK 39,819 mn (42,402), corresponding to a turnover rate of 12% for Class A shares (18%) and 44% for Class C shares (58%). Average daily trading volume was approximately 116,000 Class A shares and approximately 330,000 Class C shares.

Share and shareholder structure

Industrivärden had approximately 191,000 shareholders (196,000) at year-end.

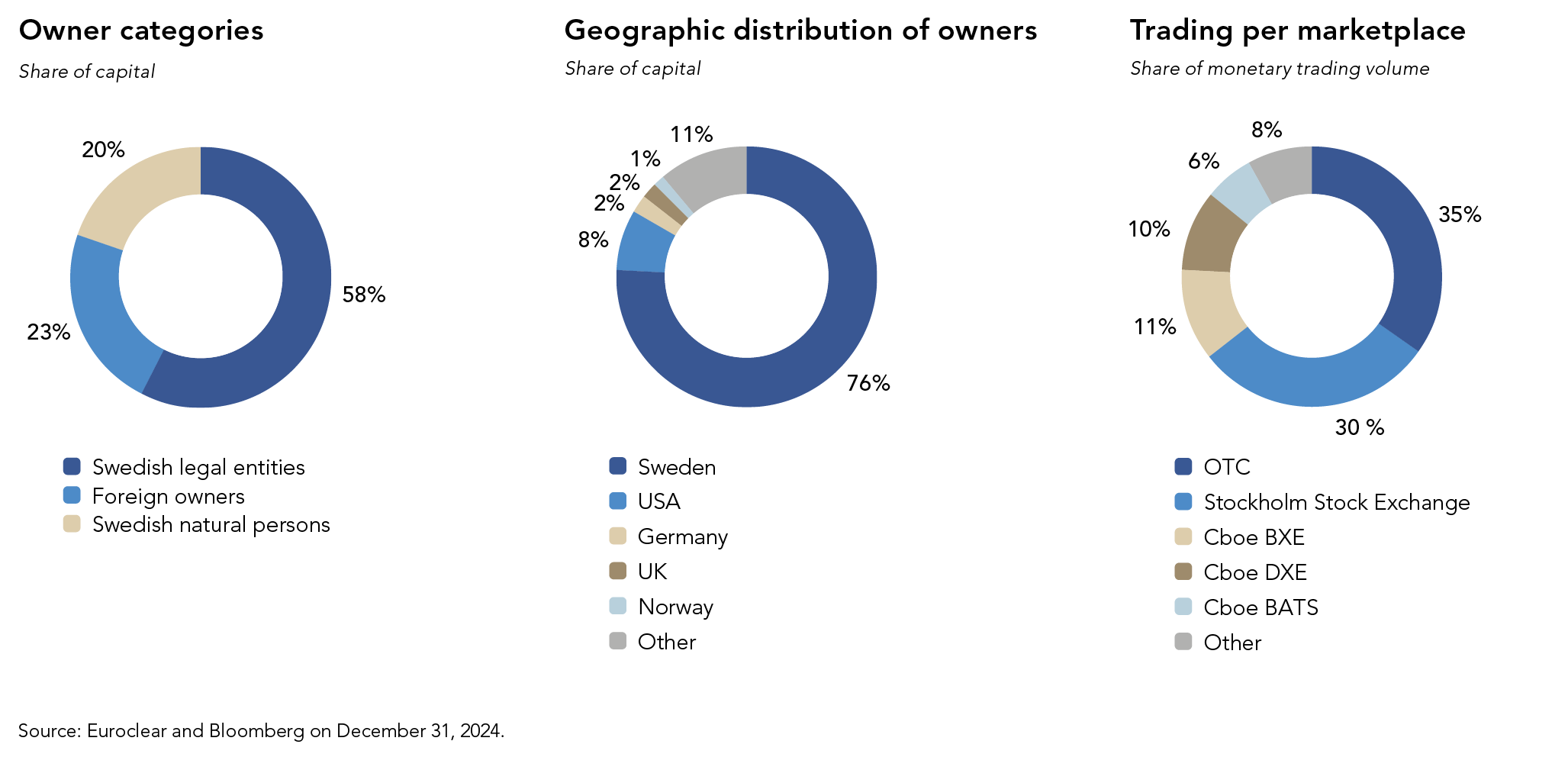

A significant majority of shareholders are private individuals, while a significant share of the capital is owned by institutional investors such as pension and asset management companies, and foundations. Foreign shareholders own 23% (23%) of the capital.

At year-end 2024 share capital totaled SEK 1,088 mn, distributed among 431,899,108 registered shares with a share quota value of SEK 2.52. Each Class A share carries entitlement to one vote, and each Class C share carries entitlement to 1/10 of a vote. All shares carry equal entitlement to the Company’s assets, earnings and dividends.

Return

Since Industrivärden’s introduction on the stock market in 1945, the Class A shares have generated a total return of approximately 2,920,000%, compared with approximately 1,340,000% for the total return index (SIXRX).

Standard deviation and beta describe the stock's volatility compared with its average return, and volatility compared with the market, respectively. Industrivärden’s Class A and C shares had standard deviations of 13.9% and 13.8%, respectively, and beta values in relation to the total return index (SIXRX) of 1.07 and 1.05, respectively, for the full-year 2024.

Share structure on June 30, 2025

Share class |

No. of shares |

No. of votes |

Capital, % |

Votes, % |

| A (1 vote) | 237,048,630 | 237,048,630.0 | 54.9 | 92.4 |

| C (1/10 vote) | 194,850,478 | 19,485,047.8 | 45.1 | 7.6 |

| Total | 431,899,108 | 256,533,677.8 | 100.0 | 100.0 |

Employee ownership

Industrivärden encourages its employees to make private investments in Industrivärden shares, as this aligns the interests of the Company’s employees with other shareholders. The long-term incentive programs adopted by the Annual General Meeting make up part of employees’ total compensation and aim to increase employees’ ownership of stock in the Company.

Shareholder structure