Our view and influence

Industrivärden’s strategy to develop and create value in its portfolio companies over the long term entails a natural focus on sustainability. Sustainable growth in value can only be created in long-term competitive companies that pay close attention to environmental, social and governance issues. Industrivärden is a responsible owner with high ambitions to participate in the development of sustainable businesses. In this way, it is possible to contribute to sustainable portfolio companies, which benefits the communities in which they operate. This involves minimizing sustainability-related risks while capitalizing on sustainability-related opportunities in a rapidly changing world.

Industrivärden sets clear demands for its portfolio companies. These include establishing strong market positions, good cash flows and financial strength as well as a distinct capacity for development. This forms a stable foundation for well-integrated sustainability work with innovations, products and services that contribute to sustainable development. By investing capital in operationally and financially sustainable companies and contributing to the portfolio companies’ strategic sustainability work, Industrivärden takes responsibility for sustainable development.

Particular focus is put on material sustainability risks and sustainability-related opportunities from risk mitigation and value-creation perspectives. Industrivärden’s overarching ambition is to be a well-informed and demanding owner with a sustainability perspective that contributes to the long-term success of its portfolio companies and to offer a long-term and sustainable investment with an attractive total return at balanced risk.

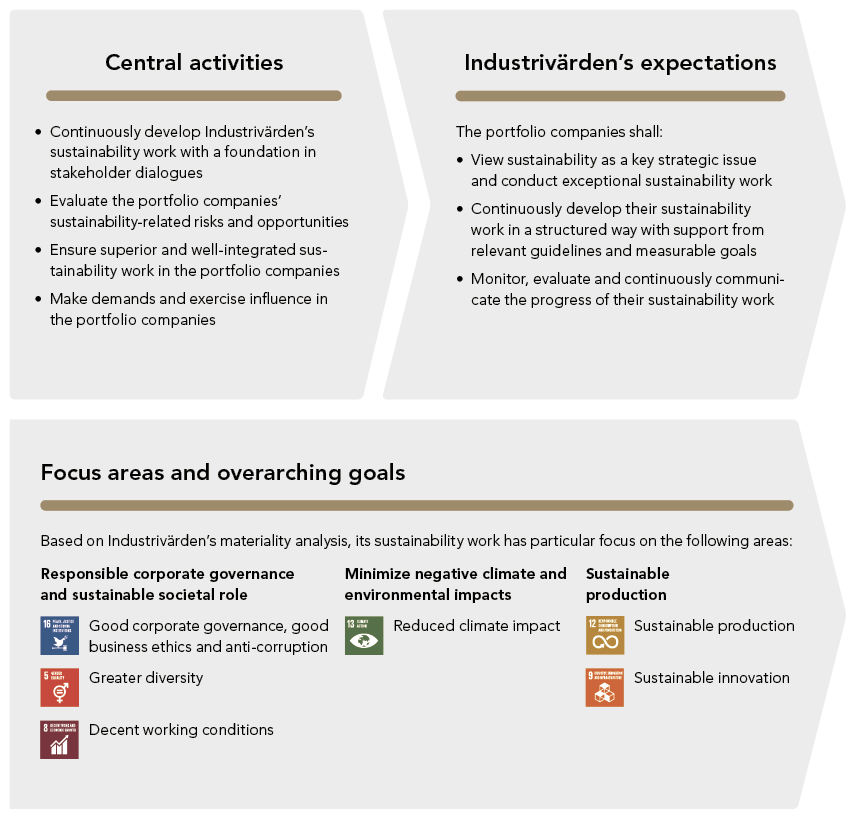

To materialize these ambitions, Industrivärden:

- Performs continuous analysis and follow-up of the respective portfolio companies in accordance with its integrated sustainability analysis;

- Formulates owner agendas for the respective portfolio companies and exerts influence in accordance with its business model;

- Conducts dialogues with selected stakeholders aimed at soliciting views in support of further development of its sustainability work.

Industrivärden expects the portfolio companies to have a sustainable approach in all aspects of their operations.

In its sustainability work Industrivärden also adheres to global initiatives such as the OECD’s Guidelines for Multinational Enterprises, the ILO’s eight fundamental conventions and the UN Guiding Principles on Business and Human Rights. From an influence perspective, the business sector has a central role in creating a sustainable world. Industrivärden is therefore a signatory of the UN Global Compact and has worked since 2015 to promote its ten principles.

To be able to conduct a qualitative analysis of the portfolio companies’ sustainability work and exercise influence in sustainability, Industrivärden must have a depth of knowledge about respective companies’ operations and sustainability-related matters. Sustainability analysis is therefore an integral part of Industrivärden’s fundamental analysis that is conducted of respective portfolio companies. In this way, sustainability issues are addressed from a holistic perspective, with a base in the portfolio companies’ respective operations, geographies and stages of development. This means that sustainability is integrated into assessments of the portfolio companies’ boards and management teams, strategic issues, and financial performance.

Individuals who represent or have ties to Industrivärden on the portfolio companies’ nominating committees and boards must have a current and thorough understanding of identified value creation measures. Against this background, Industrivärden’s owner agendas for the respective portfolio companies are discussed and evaluated on a continuous basis by Industrivärden’s board. This allows Industrivärden to exercise influence on strategic sustainability issues over time.

Industrivärden’s stakeholder and materiality analysis clearly shows that the Company’s most important task is to contribute to sustainable shareholder value in its portfolio companies. To this end, major emphasis is put on ensuring well-integrated and structured sustainability work in the portfolio companies. Key areas include responsible corporate governance and a sustainable societal role, minimized negative climate and environmental impacts, and sustainable production and innovation. Based on these focus areas, relevant goals have been established with guidance from the UN’s Agenda 2030 framework for the Sustainable Development Goals.