The 1990s: Consolidation of the industrial business and a number of major equity transactions

Consolidation of the wholly owned businesses continues, culminating in the formation of industrial company Inductus, industrial trading company Indutrade, and property company Fundament. The complexion of the equities portfolio changes with the divestment of hold- ings in PLM and AGA, new purchases in, for example, Sandvik, and a doubling of the holding in Skanska.

Financier Erik Penser joined the Board, while Anders Wall left it. In 1994, Clas Reuterskiöld became the new CEO, while Handelsbanken’s Chairman Tom Hedelius was elected onto the Board. In terms of operations, the 1990s at Industrivärden were marked by several large transactions in its portfolio of listed companies. Certain long-term holdings were sold, while others were added, acquisitions that remain significant to Industrivärden to this day.

For example, subsidiary PLM was subject to extensive restructuring. Its operations were concentrated on packaging that could be recycled or reused, such as glass packaging or beverage cans. Industrivärden then took the company to the stock exchange in 1995, only to sell its remaining holding to UK-based packaging manufacturer Rexam three years later. Rexam still has extensive operations in Sweden. This ended nearly 40 years of holdings in PLM.

Industrivärden’s holding in gas company AGA went even further back in time, all the way to the 1910s, when Handelsbanken invested in AB Gasaccumulator. However, in 1999, after AGA’s operations were refined, including divestment of its subsidiary Frigoscandia, the last shareholding was sold. German gas group Linde has been the owner of AGA ever since.

The 1990s also saw two large new acquisitions and one additional purchase in Industrivärden’s portfolio. Steel giant SSAB had been created in 1978 to secure the Swedish steel industry, with the Swedish government as principal shareholder (the company included Oxelösund ironworks, in which Industrivärden’s predecessor Handion had holdings back in 1924). The government now reduced its involvement and Industrivärden made a large acquisition, becoming the largest shareholder in SSAB.

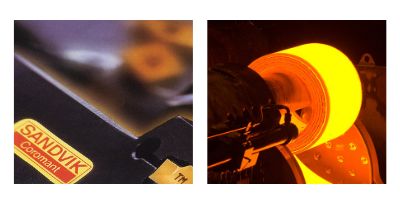

Industrivärden’s other major acquisition came towards the end of the 1990s with a significant shareholding in industrial group Sandvik. For Sandvik, this meant a return to Industrivärden’s portfolio after having been in it for a while from 1978 (after the Fagersta transaction with Kinnevik) and way back in the 1920s with Handion.

Industrivärden purchased the Sandvik shares from Skanska, which was concentrating its operations on the construction sector. Industrivärden soon doubled its holding in Skanska and became the new principal shareholder of the construction company.

Industrivärden wanted to consolidate the many industrial companies in its portfolio at the start of the 1990s. It therefore acquired the remaining shares in Investment AB Bahco. Along with Nils Dacke’s operations, they were moved to Industrivärden’s wholly owned industrial company Inductus. Subsequently, to clarify ownership and simplify corporate governance, a process began in which Industrivärden reduced the number of industrial companies it held through sales and mergers. When the process was over, Inductus was dissolved, and three remaining industrial companies became wholly owned subsidiaries of Industrivärden. In 1997, one of the remaining industrial companies was sold, along with real estate company Fundament.

At the end of the period, after sales and acquisitions, eleven portfolio companies had been reduced to seven.