- Startpage

- / Operations

- / Our history

- / The year in brief

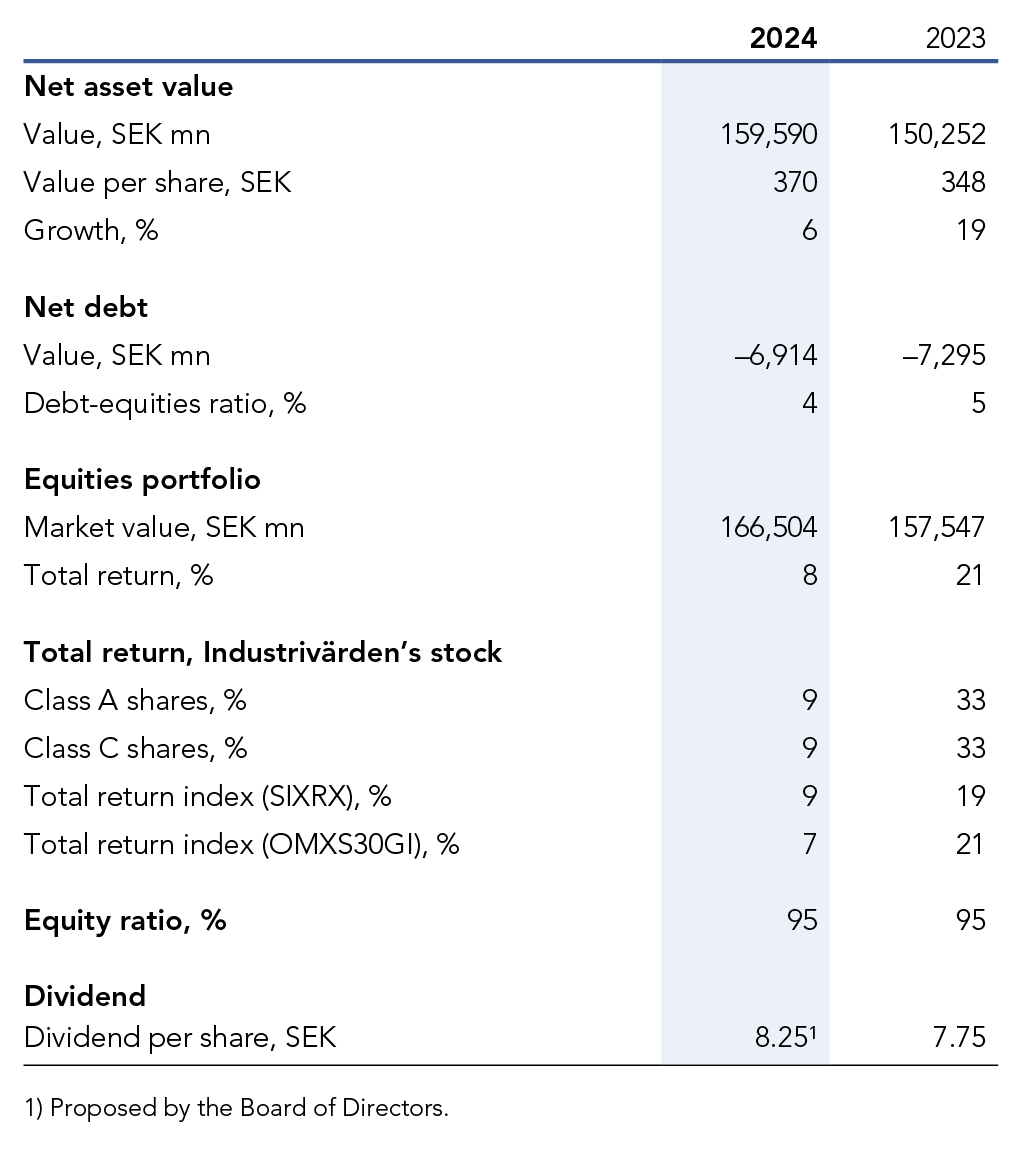

The year in brief

- Net asset value at year-end was SEK 159.6 bn, or SEK 370 per share, an increase of 6% during the year

- Net debt was SEK 6.9 bn at year-end and the debt- equities ratio was 4%

- The portfolio’s value, adjusted for purchases and sales, increased by SEK 4.4 bn to SEK 166.5 bn. Total return was 8%

- During the year, shares were purchased for a total of SEK 4.6 bn, of which SEK 1.5 bn in Volvo, SEK 1.5 bn in Sandvik, SEK 0.8 bn in SCA, SEK 0.7 bn in Essity and SEK 0.1 bn in Alleima

- Total return was 9% for the Class A shares, as well as for the Class C shares

- The Board of Directors resolved to increase in the dividend to SEK 8.25 per share (7.75)

Key data on December 31

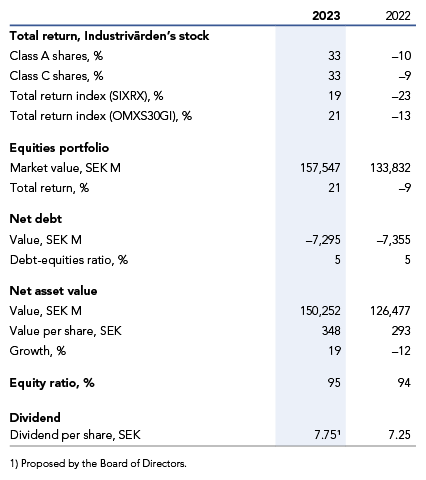

- Net asset value at year-end was SEK 348 per share,

an increase of 19% during the year - The portfolio’s value, adjusted for purchases and sales,

increased by SEK 20.9 billion to SEK 157.5 billion. The

total return was 21% - During the year, shares were purchased for a total

of SEK 2.9 billion, of which SEK 1.1 billion in Sandvik,

SEK 0.9 billion in Volvo, SEK 0.6 billion in Handelsbanken,

and SEK 0.2 billion in SCA - The debt-equities ratio was 5%

- The total return was 33% for the Class A shares, as well

as for the Class C shares - The Board of Directors proposes an increase in the

dividend to SEK 7.75 per share (7.25)

Key data on December 31

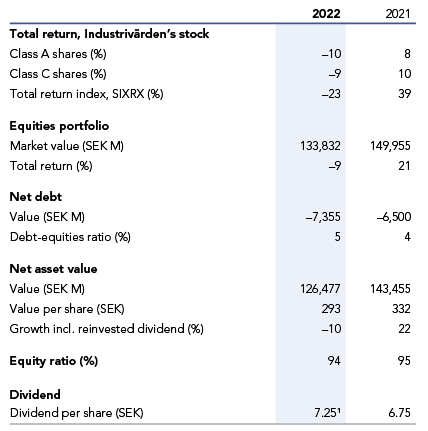

- Net asset value at year-end was SEK 293 per share, a decrease of 10% for the year including reinvested dividend

- The portfolio’s value, adjusted for purchases and sales, decreased by SEK 19.3 billion to SEK 133.8 billion. The total return was –9%

- Alleima became a new portfolio company as a result of Sandvik’s dividend of the company to its shareholders

- During the year, shares were purchased for a total of SEK 2 billion, of which SEK 1.3 billion in Volvo, SEK 0.7 billion in Alleima, SEK 0.5 billion in Sandvik, SEK 0.4 billion in Handelsbanken, SEK 0.2 billion in Essity, and SEK 0.2 billion in Skanska

- The debt-equities ratio was 5%

- The total return was –10% for the Class A shares and –9% for the Class C shares

- The Board of Directors proposes an increase in the dividend to SEK 7.25 per share (6.75)

Key data in December 31

- Net asset value at year-end was SEK 332 per share, an increase of 22% for the year including reinvested dividend

- The total return was 8% for the Class A shares and 10% for the Class C shares

- The value of the equities portfolio, adjusted for purchases and sales, increased by SEK 19 billion to SEK 150 billion. The total return was 21%

- During the year, shares were purchased in Sandvik for SEK 2.5 billion, in Volvo for SEK 0.8 billion, in Handelsbanken for SEK 0.5 billion and in Essity for SEK 0.5 billion

- The remaining shareholding in SSAB was sold for SEK 2.0 billion

- During the year a distribution in kind was received from Handelsbanken in the form of Industrivärden Class A shares, which were subsequently canceled pursuant to a resolution by an Extraordinary General Meeting

- The debt-equities ratio was 4%

Values as per December 31 2021

| 2021 | 2020 | |

| Total return, Industrivärden's stock | ||

| Class A shares (%) | 8 | 18 |

| Class C shares (%) | 10 | 18 |

| Total resturn index, SIXRX (%) | 39 | 15 |

| Equities portfolio | ||

| Market value (SEK M) | 149,955 | 128,893 |

| Total return (%) | 21 | 7 |

| Interest-bearing net debt | ||

| Value (SEK M) | -6,500 | -7,654 |

| Debt-equities ratio | 4 | 6 |

| Net asset value | ||

| Value (SEK M) | 143,455 | 121,239 |

| Net asset value per share (SEK) | 332 | 279 |

| Growth incl. reinvested dividend (%) | 22 | 8 |

| Equities ratio (%) | 95 | 94 |

| Dividend | ||

| Dividend per share (SEK) | 6.75 | 8.25 |

The Board of Directors proposes that the 2022 Annual General Meeting resolve in favor of an ordinary dividend of SEK 6.75 per share. In 2021 the AGM resolved to pay an ordinary dividend of SEK 6.25 per share and an extra dividend of SEK 2.00 per share.

- The total return was 18% for the Class A and Class C shares, compared with 15% for the total return index (SIXRX)

- Net asset value at year-end was SEK 279 per share, an increase during the year of 8%, including reinvested dividend

- The value of the equities portfolio, adjusted for purchases and sales, increased by SEK 8.0 billion to SEK 128.9 billion. The total return was 7%

- During the year, shares were purchased in Volvo A for SEK 2.1 billion, Essity B for SEK 0.9 billion, Handelsbanken A for SEK 0.6 billion, SCA B for SEK 0.4 billion and Sandvik for SEK 0.3 billion. In addition, shares were sold in Essity A for SEK 0.2 billion.

- The debt-equities ratio was 6%

- On account of the uncertain situation in the world in 2020 arising out of the Covid-19 pandemic, the Board of Directors proposed that no dividend be paid, which was adopted by the Annual General Meeting

Values as per December 31 2020

| 2020 | 2019 | |

| Total return, Industrivärden's stock | ||

| Class A shares (%) | 18 | 30 |

| Class C shares (%) | 18 | 30 |

| Total resturn index, SIXRX (%) | 15 | 35 |

| Equities portfolio | ||

| Market value (SEK M) | 128,893 | 116,750 |

| Total return (%) | 7 | 35 |

| Interest-bearing net debt | ||

| Value (SEK M) | -7,654 | -4,032 |

| Debt-equities ratio | 6 | 3 |

| Net asset value | ||

| Value (SEK M) | 121,239 | 112,718 |

| Net asset value per share (SEK) | 279 | 259 |

| Growth incl. reinvested dividend (%) | 8 | 35 |

| Equities ratio (%) | 94 | 96 |

| Dividend | ||

| Dividend per share (SEK) | 8.25 | 0.00 |

Industrivärden's performance

Equities portfolio

The value of the equities portfolio, adjusted for purchases and sales, increased by SEK 26.1 billion to SEK 116.7 billion.

Investment activities

During the year, shares were purchased in Volvo A for SEK 1.6 billion, Sandvik for SEK 0.5 billion, Skanska B for SEK 0.4 billion, Essity B for SEK 0.3 billion, SCA B for SEK 0.2 billion and Handelsbanken A for SEK 0.2 billion. In addition, shares were sold in Essity A for SEK 0.3 billion and in SCA A for SEK 0.1 billion. Shares in ICA Gruppen worth SEK 4.1 billion were delivered in connection with the redemption of outstanding exchangeable, after which the remaining shares were sold.

Net asset value

Net asset value at year-end was SEK 259 per share, an increase during the year of 32% and 35%, respectively, including reinvested dividend.

Total return - Industrivärden shares

The total return was 30% for the Class A and Class C shares, compared with 35% for the total return index (SIXRX).

Gearing

The debt-equities ratio was 3%, a decrease of 4 percentage points during the year.

Proposed dividend

The Board of Directors proposes a dividend of SEK 6.00 (5.75) per share.

Values as per December 31 2019

| 2019 | 2018 | |

| Total return, Industrivärden's stock | ||

| Class A shares (%) | 30 | -11 |

| Class C shares (%) | 30 | -9 |

| Total resturn index, SIXRX (%) | 35 | -4 |

| Equities portfolio | ||

| Market value (SEK M) | 116,750 | 92,170 |

| Total return (%) | 35 | -8 |

| Interest-bearing net debt | ||

| Value (SEK M) | -4,032 | -6,601 |

| Debt-equities ratio | 3 | 7 |

| Net asset value | ||

| Value (SEK M) | 112,718 | 85,201 |

| Net asset value per share (SEK) | 259 | 196 |

| Growth incl. reinvested dividend (%) | 35 | -9 |

| Equities ratio (%) | 96 | 91 |

| Dividend | ||

| Dividend per share (SEK) | 6.00 | 5.75 |

| Dividend growth (%) | 4 | 5 |

Industrivärden's performance

Equities portfolio

The value of the equities portfolio – adjusted for purchases and sales – decreased by SEK 11.9 billion to SEK 92.2 billion (107.3). The total return was –8%.

Investment activities

- In April shares in SSAB were sold for SEK 3.1 billion, for a favorable return.

- In November shares in ICA Gruppen were sold for SEK 1.7 billion for a favorable return, and a divestment was enabled of the remaining holding in May 2019.

- During the year, shares were bought in Handelsbanken for SEK 0.7 billion, in Sandvik for SEK 0.6 billion, and in Volvo for SEK 0.6 billion.

Active ownership

During the year, Industrivärden exercised an active ownership role in its portfolio companies with the goal of creating value over time.

Net asset value

Net asset value at year-end was SEK 196 per share (221), a decrease of 12% for the year and 9% including reinvested dividend.

Total return - Industrivärden shares

The total return was –11% for Industrivärden’s Class A shares and –9% for the Class C shares, compared with –4% for the total return index (SIXRX).

Gearing

The debt-equities ratio was 7%, a decrease of 3 percentage points during the year.

Proposed dividend

The Board of Directors proposes a dividend of SEK 5.75 (5.50) per share.

Industrivärden's performance

Equities portfolio

Adjusted for purchases and sales, the value of the equities portfolio increased by SEK 12.9 billion to SEK 107.3 billion (94.2). The total return was 17%.

Net asset value

Net asset value at year-end was SEK 221 per share (191), an increase of 16% for the year and 18% including reinvested dividend.

Total return - Industrivärden shares

The total return was 20% for Industrivärden’s Class A shares and 22% for the Class C shares, compared with 9% for the total return index (SIXRX).

Gearing

The debt-equities ratio was 10%, a decrease of 2 percentage points during the year.

Proposed dividend

The Board of Directors proposes a dividend of SEK 5.50 (5.25) per share.

A selection of strategic activities in portfolio companies

Volvo

Through determined work on achieving sharpened focus, decentralized responsibility, stronger cost control and continuous improvements, Volvo has appreciably strengthened its profitability and financial position. Sales growth also increased significantly during the year. The company has announced new financial targets and continues to evaluate its business structure.

Essity/SCA

The split of SCA into the hygiene and health company Essity and the forest products company SCA enables increased focus and scope for action in the respective portfolio companies over time. In connection with the split, Essity’s stock was listed on June 15, 2017. During the year Essity presented new financial targets, and SCA’s investment in increased capacity at the Östrand pulp mill developed according to plan.

Ericsson

Erissson is facing significant operational and financial challenges that are being addressed with a new business strategy and simplified organizational structure, combined with substantial cost reductions. During the year, previously taken actions began to generate effects, and Ericsson also presented new financial targets. Considerable energy is being dedicated to focusing and developing existing positions of strength and on regaining technological leadership.

Industrivärdens performance

Equities portfolio

Adjusted for purchases and sales, the value of the equities portfolio increased by 16% to SEK 94.2 billion (81.8).

Net asset value

Net asset value at year-end was SEK 191 per share (160), an increase of 20% for the year and 23% including reinvested dividend.

Total return

The total return was 17% for Industrivärden’s Class A shares and 21% for the Class C shares, compared with 10% for the Stockholm Stock Exchange’s total return index (SIXRX).

Indebtedness

The debt-equities ratio was 12%, a decrease of 3 percentage points during the year.

A selection of strategic activities in portfolio companies

SCA

The proposed split into two companies with leading businesses in hygiene and forest products, respectively, will result in greater focus and room to maneuver, which will lead to long-term value creation over time. The strategic acquisition of BSN medical, with products in wound care and compression therapy, creates a new platform for growth.

Volvo

The establishment of a brand- and business area–driven organization with decentralized responsibility, combined with strong cost control and focus on continuous improvement, is contributing to increased efficiency and profitability. The company has also announced divestments of non-core businesses.

Sandvik

The new, decentralized organizational structure, with a reduction of the number of business areas from five to three, will result in a more effective and customer-centric business model with greater transparency, and clearer allocation of responsibilities. The company intends to divest non-core business parts.

SSAB

The rights issue in which Industrivärden subscribed for its allotment strengthens the company’s long-term value potential. Continued efficiency improvements and adaption to the challenging market situation.

Equities portfolio

Adjusted for purchases and sales, the value of the equities portfolio increased by 1% to SEK 81.8 billion (83.1). During the year, the entire holding in the Finnish company Kone was sold for SEK 1.2 billion.

Net asset value

Net asset value at year-end was SEK 160 per share (158), an increase of 1% for the year and 5% including reinvested dividend.

Total return

The total return was 15% for Industrivärden’s Class A shares and 11% for the Class C shares, compared with 10% for the Stockholm Stock Exchange’s total return index (SIXRX).

Fredrik Lundberg new Chairman of the Board in May 2015

At the Annual General Meeting on May 6, 2015, Fredrik Lundberg was elected as new Chairman of the Board. Fredrik Lundberg has been a director on Industrivärden’s board since 2004.

Helena Stjernholm new CEO in September 2015

On September 1, 2015, Helena Stjernholm took office as CEO of Industrivärden. She has served in various positions within the private equity firm IK Investment Partners since 1998, and prior to that worked as a consultant for Bain & Company.

Strategic review

A review was conducted of Industrivärden’s strategy in an effort to strengthen operations. Development steps and changes were carried out on a continuing basis during the autumn of 2015 and will continue in spring 2016.

Proposed dividend

The Board of Directors proposes a dividend of SEK 5.00 (6.25) per share, which corresponds to a dividend yield of 3.4% for the Class C shares.

Net asset value

- Net asset value at year-end was SEK 158 per share (155), an increase of 9% for the year adjusted for conversions and including reinvested dividends.

Total return

- The total return for Industrivärden’s Class A shares was 13%, which was 3 percentage points less than the return index.

- The total return for Industrivärden’s Class C shares was 16%, which was level with the return index.

- For longer periods of time, Industrivärden’s Class C shares have generated a higher total return than the Stockholm Stock Exchange. This performance is even better in comparison with Europe and World indices.

Equity transactions during the year

- Total net purchases per holding amounted to SEK 2,265 M, and total net sales per holding amounted to SEK 704 M. Stocks were purchased for a net total of SEK 1,561 M.

- The largest net purchases were in Volvo, for SEK 1,188 M, followed by Sandvik, for SEK 542 M. The largest net sales were in Skanska, for SEK 117 M, and Ericsson, for SEK 45 M.

Favorable profit from trading

- Trading generated a profit of SEK 178 M, which covered the management cost of SEK 146 M, or 0.18% of managed assets.

Conversion of first convertible loan

- The entire convertible loan 2010-2015 was converted to 46.1 million new Class C shares, adding SEK 5.8 billion to shareholders’ equity.

Refinancing through an exchangeable bond

- A SEK 4.4 billion exchangeable bond was issued as part of the continuous refinancing of the debt portfolio. The bond was issued at a premium to the existing share price for ICAGruppen of approximately 38% and carries no interest.

Proposed dividend

- The Board of Directors proposes a dividend of SEK 6.25 per share (5.50), corresponding to a dividend yield of 4.6% (4.5%) for the Class C shares, compared with 3.4% for the Stockholm Stock Exchange.

Net asset value

- Net asset value at year-end was SEK 155 per share (129), an increase of 24% (29%) for the year including reinvested dividends.

Total return

- The total return for Industrivärden’s Class A shares was 23%, which is 5 percentage points less than the return index.

- The total return for Industrivärden’s Class C shares was 18%, which is 10 percentage points less than the return index.

- For the longer 5-, 10-, 15- and 20-year periods, Industrivärden’s Class C shares have generated a higher total return than the Stockholm Stock Exchange. This performance is even better in comparison with the European and World indexes.

Equity transactions during the year

- Stocks were purchased for SEK 6,916 M (3,262) and sold for SEK 8,305 M (2,149). Stocks were sold for a net amount of SEK 1,389 M (–1,114).

- In order to build net asset value and to create a better balance in the portfolio, a number of major transactions were carried out in 2013:

- New, long-term ownership position in ICA Gruppen. Acquisition of 10% of the votes and capital in ICA Gruppen, one of the leading retail companies in the Nordic region. The investment totaled SEK 2.4 billion. At year-end 2013, the market value of the holding was SEK 4.0 billion.

- Holding in Höganäs sold. Sale of entire holding in Höganäs for SEK 1.5 billion to H Intressenter. Industrivärden’s total return during the time of its holding was 11% per year, compared with 10% per year for the total return index.

- Holding in Indutrade sold. Sale of entire holding in Indutrade for SEK 3.3 billion. During the holding period since 1989, Industrivärden’s initial investment of approximately SEK 0.3 billion generated receipt of cash flows totaling SEK 6.7 billion.

- New investment in Kone. A shareholding has been built up in the Finnish elevator manufacturer Kone. The market value of the holding is SEK 0.9 billion.

Favorable profit from short-term trading

- Short-term trading generate a profit of SEK 140 M, and the management cost was SEK 130 M, or 0.17% of managed assets.

Conversion begun of first convertible loan

- In 2013, 5.5 million new Class C shares were issued, corresponding to 12% of the convertible loan 2010–2015, as a result of requests to convert convertibles to stock.

Proposed dividend

- The Board of Directors proposes a dividend of SEK 5.50 per share (5.00), corresponding to a dividend yield of 4.5% (4.6%) for the Class C shares, compared with 3.7% (3.5%) for the Stockholm Stock Exchange.

Active ownership in the portfolio companies

- Ensure profitability in core markets in Europe and North America.

- Continued focus on growth in selected market segments.

Net asset value

- Net asset value at year-end was SEK 129 per share (104), an increase of 29% (–28%) for the year including reinvested dividends.

Total return

- The total return for Industrivärden’s Class C shares was 37%, which was 21 percentage points better than for the return index.

- For the longer 5-, 10-, 15- and 20-year periods, Industrivärden’s stock generated a higher total return than the total return index (SI XRX). This performance is even stronger in comparison with a European or world index.

Equity transactions during the year

- Stocks were purchased for SEK 3 262 M (11,388) and sold for SEK 2 149 M (6,927).

- Stocks were purchased for a net total of SEK 1,114 M (4,461).

Single largest shareholder in Volvo

- After additional purchases of 10 million Class A shares in Volvo, and through Renaults conversion of Volvo Class A shares to Class B shares, Industrivärden is now the single largest shareholder in the company. The ownership corresponds to 6.2% of the capital and 18.7% of the votes.

Trading covers management cost

- Industrivärden’s short-term equity trading generated a profit of SEK 118 M, and management costs amounted to SEK 123 M, or 0.18% of assets under management.

First convertible bond is "in the money"

- Due to the weaker euro, it is profitable for owners of the convertible bond worth EUR 500 M maturing in 2015 to convert at a share price of SEK 94/share (corresponding to a price of SEK 154 per share

for the bond maturing in 2017).

Proposed dividend

- The Board of Directors proposes a dividend of SEK 5.00 (4.50) per share, which corresponds to a dividend yield of 4.6% (5.5%) for the Class C shares.

Active ownership in the portfolio companies

- Ensure long-term growth plans.

- Manage rising commodity and energy costs.

Net asset value

- Net asset value at year-end was SEK 104 per share (149), a decrease of 28% (increase of 37%) for the year including reinvested dividends.

Total return

- The total return for Industrivärden’s Class C shares was –28%, which was 14 percentage points lower than for the return index.

- During the last twenty years, the average annual total return for the Class C shares was 13%, which exceeded the return index by 1 percentage point per year.

Equity transactions during the year

- Stocks were purchased for SEK 11,388 M (5,644) and sold for SEK 6,927 M (3,097).

- Stocks were purchased for a net total of SEK 4,461 M (2,547).

Large purchase of shares in Volvo

- Additional purchases of shares in Volvo for SEK 2,873 M, corresponding to 4.1% of the votes.

Short-term trading

- As in previous years, Industrivärden’s short-term equity trading covered the Company’s management costs.

Successful issues of convertible bonds

- In January 2011 Industrivärden issued additional six-year convertible bonds worth EUR 550 M to obtain low-cost financing with the opportunity to issue new equity. In January 2010, five-year convertible bonds worth EUR 500 M were issued.

Proposed dividend

- The Board of Directors proposes a dividend of SEK 4.50 (4.00) per share, which corresponds to a dividend yield of 5.2% (3.3%) for the Class A shares.

Active ownership in portfolio companies

- Follow through on long-term growth plans.

- Handle more normalized demand.

- Continued focus on capacity adjustment and cost-cutting.

Net asset value

- Net asset value at year-end was SEK 149 (111) per share, an increase of 37% (87%) for the year including reinvested dividends.

Total return

- The total return for Industrivärden’s Class A shares was 48%, which was 21 percentage points better than for the return index.

- During the last ten years, the average annual total return for the Class C shares was 7%, which exceeded the return index by 1 percentage points per year.

Equity transactions during the year

- Stocks were purchased for SEK 5,644 M (1,245) and sold for SEK 3,097 M (1,645).

- Stocks were purchased for a net total of SEK 2,547 M (–400), with growth in value of 41% at year-end.

Large purchases of shares in Volvo

- Additional purchases of shares in Volvo for SEK 1,770 M, corresponding to 2.2% of the votes, at an average purchase price of SEK 78/share.

- The result of a total return swap for acquisition of shares in Volvo amounted to SEK 257 M.

Sale of Munters

- The holding in Munters was sold for SEK 843 M; the total return during Industrivärden’s ownership was 50%.

Short-term trading

- In January 2010 Industrivärden issued five year convertible bonds worth EUR 500 M, and in January 2011 Industrivärden issued additional six-year convertible bonds valued at EUR 550 M in order to obtain lowcost financing with the opportunity to issue new equity.

Proposed dividend

- The Board of Directors proposes a dividend of SEK 4.00 (3.00) per share, which corresponds to a dividend yield of 3.3% (3.4%) for the Class A shares.

Active ownership of portfolio companies

- Major focus on capacity adaptation and cost-cutting.

- Focus on capital structure.

- Maintain long-term growth plans.

Issue of convertible bonds

- In January 2010 Industrivärden issued five-year convertible bonds worth EUR 500 M in order to obtain low-cost financing with the opportunity to issue new equity.

Net Asset Value

- Net asset value at year-end was SEK 62 (142) per share,a decrease of 55% (–3%) for the year including reinvested dividends.

- During the last ten-year period, average annual growth in net asset value, including reinvested dividends, was 1%.

Total Return

- The total return for Industrivärden’s Class A shares was –47%, compared with –39% for the return index.

- During the last ten years, the average annual total return for the Class A shares was 5%, which exceeded the return index by 2 percentage points per year.

Equity transactions

- During the year, Industrivärden purchased Volvo A shares for SEK 1,830 M.

- Total purchases of stock amounted to SEK 4,644 M (8,834).

- Shares in SSAB were sold for SEK 963 M.

- Total sales of stocks amounted to SEK 4,314 M (2,124).

Proposed dividend

- The Board of Directors proposes a dividend of SEK 4.50 (5.00) per share, which corresponds to a dividend yield of 7.9% (4.4%) for the Class A shares.

Net Asset Value

- Net asset value per share at year-end was SEK 142 (151), a decrease of 3% (increase of 24%) for the year including reinvested dividend.

- During the last ten-year period, average annual growth in net asset value, including reinvested dividends, was 14%.

Total Return

- The total return was –14% for Industrivärden Class A shares and –15% for Industrivärden Class C shares, compared with –3% for the return index.

- During the last ten-year period, the total return for the Class A and Class C shares averaged 12% and 11% per year, respectively, which exceeded the return index by 2 percentage points and 1 percentage point per year, respectively.

Purchases of Stocks

- During the year Industrivärden purchased Volvo A shares for SEK 4,216 M and stock in SSAB for SEK 2,792 M, including SEK 2,275 M in shares subscribed through SSAB’s rights issue.

- Total purchases of stocks amounted to SEK 8,834 M (3,193).

Sales of Stocks

- The shareholding in Tandberg Television was sold for SEK 728 M.

- Total sales of stocks amounted to SEK 2,124 M (2,072).

Short-Term Trading

- Income from short-term trading in derivatives and equities totaled SEK 142 M (173).

Proposed Dividend

- The Board of Directors proposes a dividend of SEK 5.00 (4.50) per share, an increase of 11 %.

- Net asset value at year-end was SEK 303 (250) per share, an increase of 21% (32%) for the year.

- During the last ten-year period, average annual growth in net asset value, including reinvested dividends, was 17%.

- The total return was 29% for Industrivärden Class A shares and 32% for Industrivärden Class C shares, compared with 28% for the return index.

- During the last ten-year period, the total return for both classes of stock averaged 18% per year, which exceeded the return index by 5 percentage points per year.

- During the year Industrivärden purchased stock in Tandberg Television ASA for SEK 737 M and in Handelsbanken (A-shares) for SEK 202 M.

- Total purchases of stocks amounted to SEK 3,193 M (3,023).

- Total sales of stocks amounted to SEK 2,072 M (3,964).

- Industrivärden’s last remaining operating subsidiary, Isaberg Rapid, was sold.

- Earnings from short-term trading in derivatives and equities totaled SEK 173 M (122).

- The Board of Directors proposes a dividend of SEK 9.00 (7.00) per share, an increase of 29%.

- The Board has also proposed a 2:1 stock split.

- Net asset value at year-end was SEK 250 (189) per share, an increase of 32% (22%) for the year. Including reinvested dividends, net asset value rose 37% (25%).

- The total return was 33% for Industrivärden Class A shares and 36% for Industrivärden Class C shares, compared with 36% for the return index. During the last ten- ear period, Industrivärden’s stock has delivered an average annual total return of 20%, outperforming the return index by 6 percentage points per year.

- During the year Industrivärden purchased stock in SCA for a net of SEK 1,329 M and in Höganäs for SEK 471 M.

- Total purchases of stocks amounted to SEK 3,023 M (5,203).

- The wholly owned technology trading company Indutrade was introduced on the stock market through an IPO in which Industrivärden sold 62.5% of its shareholding for SEK 1,585 M. Industrivärden’s net asset value pertaining to Indutrade, including dividends received, increased during the year by SEK 1,197 M, or SEK 6 per share.

- The shareholding in Ossur was sold for SEK 1,008 M. Industrivärden’s net asset value pertaining to Ossur increased by SEK 225 M during the year.

- Through a share redemption program, shares in Sandvik were sold for SEK 436 M.

- Total sales of stocks amounted to SEK 3,964 M (2,956).

- The result of short-term trading in derivatives and equities was SEK 122 M (106).

- The Board of Directors proposes a dividend of SEK 7.00 (6.00) per share, an increase of 17%.

- Net asset value at year-end was SEK 189 (156) per share, an increase of 22% for the year. Including reinvested dividends, net asset value rose 25%.

- The total return for Industrivärden’s stock was 46%, compared with 21% for the return index.

- During the year Industrivärden purchased stock in Handelsbanken and Sandvik worth SEK 3,432 M and thereby consolidated its position in two profitable companies with good development potential.

- Complementary stock purchases were made in SSAB, Munters and Ossur, totaling SEK 309 M.

- Total purchases of stocks amounted to SEK 5,203 M and total sales amounted to SEK 2,956 M.

- The result of short-term equity trading and derivative transactions was SEK 103 M (100), which more than amply covered Industrivärden’s management costs.

- The Board of Directors proposes a dividend of SEK 6.00 per share (5.50).

- Net asset value at year-end was SEK 156 (126) per share, an increase of SEK 30 per share in 2003. Including reinvested dividends, net asset value rose SEK 37 per share.

- The total return for Industrivärden's stock was 28%, compared with 34% for the return index.

- During the period December 2002 to April 2003, 11% of the shares in the moisture control company Munters were acquired for SEK 490 M.

- Shares in SCA, Handelsbanken and SSAB were also acquired during the year for a total of SEK 1,303 M.

- In November an December the entire shareholding in Skandia was sold for a total of SEK 1,353 M, giving rise to a capital loss of SEK 1,510 M.

- The Board of Directors proposes a dividend of SEK 5.50 per share (5.80).

- Net asset value at year-end was SEK 126 (204) per share.

- The total return for Industrivärden's stock was -36%, compared with

- -36% for the Total Return Index .

- In April the holding in the Danish pharmaceutical company Lundbeck was sold for SEK 2,363 M, generating a capital gain of SEK 1,498 M.

- In May and November, stock worth SEK 275 M - corresponding to 16% of the total number of shares - was purchased in the medical technology company Ossur.

- In June the wholly owned door automation company Besam was sold to the Assa Abloy lock group for SEK 3,050 M, generating a capital gain of SEK 2,334 M.

- In September Industrivärden subscribed for SEK 762 M in stock in Ericsson's rights issue.

- Net debt from a portfolio perspective decreased by SEK 3.2 billion, to SEK 1.9 billion at year-end. The net debt-equity ratio decreased from 11% to 7%.

- The Board of Directors proposes a dividend of SEK 5.00 per share (5.00), plus a bonus dividend of SEK 0.80 per share (3.35), for a total dividend of SEK 5.80 per share (8.35).

- The total return for Industrivärden’s stock was -16%, compared with -15% for the Findata Total Return Index. The share price fell by 20%, compared with a drop of 17% for the General Index.

- Net asset value at year-end was SEK 204 (2801) per share, broken down into SEK 210 (284) for the listed portfolio, SEK 21 (22) for unlisted holdings, and SEK -27 (-26) for other assets and liabilities.

- The value of the portfolio of listed stocks on December 31, 2001, was SEK 40,535 M (54,961). Adjusted for purchases and sales, the portfolio’s value decreased by 24% from the beginning of the year, while the General Index fell by 17%. The total return for the listed portfolio was -22%, compared with -15% for the Findata Total Return Index.

- The entire holding in Pharmacia was sold during the fourth quarter. During the year listed stocks were sold for a total of SEK 2,975 M, for a capital gain of SEK 713 M. Stock purchases amounted to SEK 1,506 M.

- The three wholly owned industrial and trading companies all expanded during the year through company acquisitions or new establishment.

- Consolidated earnings after financial items were SEK 1,510 M (1,364). Of this total, gains on sales of stocks accounted for SEK 644 M (366), dividends from stocks for SEK 918 M (839), and other earnings items for SEK -52 M (159).

- The Board of Directors proposes a dividend of SEK 5.00 per share (5.00), plus a bonus dividend of SEK 3.35 per share (3.40), for a total dividend of SEK 8.35 per share (8.40). Interest per CPN would thus be SEK 9.60 (9.66).

- In October an extraordinary general meeting resolved to prematurely cancel Industrivärden’s CPN loan 1988/2028 in order to simplify the share structure, facilitate valuation of the Company and enhance the liquidity of Industrivärden’s stock. In accordance with the terms of the loan, CPN owners received one and one-tenth shares (1.1) per CPN upon conversions made after October 25, 2001. As a result of the cancellation of the CPN loan, the total number of shares increased by 21.4 million to 193.1 million.

- Industrivärden’s stock gained 11 percent for the year, compared with a drop of 12 percent for the General Index. The total return was 14 percent, compared with -11 percent for the Findata Total Return Index.

- The value of the portfolio of listed stocks on December 31, 2000, was SEK 54,961 M (54,298). Adjusted for purchases and sales, the portfolio’s value decreased by 4 percent from the beginning of the year, while the General Index fell by 12 percent. The total return for the listed portfolio was -2 percent, compared with -11 percent for the Findata Total Return Index.

- Net asset value at year-end was SEK 283 (298) per share and CPN.

- Net investments of SEK 1,373 M were made during the year in the pharmaceutical industry and SEK 1,776 M in financial services.

- Industrivärden signed an agreement with Ericsson and others to form Ericsson Venture Partners, targeting investments in mobile Internet development. The aggregate committed fund capital amounts to USD 300 M, of which Industrivärden’s share is 25 percent.

- Consolidated earnings after financial items were SEK 1,364 M (4,603). Of this total, gains on sales of stocks accounted for SEK 366 M (3,635, including 3,327 from the sale of the holding in AGA), dividends from listed stocks for SEK 821 M (775), and other earnings for SEK 177 M (193).

- The Board of Directors proposes that the dividend for 2000, including a bonus, be raised by SEK 2.20 to SEK 8.40 per share. Interest per CPN would thus be SEK 9.66.

- Industrivärden's stock gained 70 percent for the year, compared with 66 percent for the General Index. The total return was 76 percent, compared with 70 percent for the Findata Total Return Index.

- The value of the portfolio of listed stocks on December 31, 1999, was SEK 54,298 M (30,043). Adjusted for purchases and sales, the portfolio's value rose 87 percent from the beginning of the year, while the General Index rose 66 percent. The total return for the portfolio was 91 percent, compared with 70 percent for the Findata Total Return Index.

- Net asset value at year-end was SEK 298 (160) per share and CPN, an increase of 86 percent (7) from the beginning of the year.

- The shareholding in AGA was sold for a capital gain of SEK 3,327 M.

- The subsidiaries Hydrauto, Rapid Granulator and Timelox were sold for a combined capital gain of SEK 100 M.

- Consolidated earnings after financial items were SEK 4,603 M (2,148). Of this total, gains on sales of stocks accounted for SEK 3,634 M (1,003), dividends from listed stocks for SEK 775 M (SEK 1,067 M, including one-time dividends of SEK 392 M), and other earnings for SEK 193 M (78).

- The Board of Directors proposes that the ordinary dividend for 1999 be raised by SEK 0.50 to SEK 5.00 per share. In addition, the Board proposes a bonus dividend for 1999 of SEK 1.00 per share, and thus a total dividend for 1999 of SEK 5.00 per share. Interest per CPN would thus be SEK 6.90.

- The value of the portfolio of listed stocks on December 31, 1998, was SEK 20,043 M (28,682). Adjusted for purchases and sales, the portfolio's value rose 5 percent from the beginning of the year. The general index rose by 10 percent. The total return for the portfolio was 7 percent.

- Net asset value at year-end was SEK 160 (150) per share and CPN, an increase of 7 percent from the beginning of the year.

- The shareholding in PLM, corresponding to 23 percent of the capital, was sold for SEK 1,180 M, generating a capital gain of SEK 712 M.

- Following a net purchase of stock in Skanska, totaling SEK 1,190 M, Industrivärden became the largest shareholder in terms of votes. The net involvement increased by SEK 816 M after the sale of all shares in Drott.

- Consolidated earnings after financial items were SEK 2,148 (2,404). Of this total, gains on sales of stocks accounted for SEK 1,003 M (1,865), dividends from listed stocks for EK 1,067 M (426), and other earnings for SEK 78 (113).

- The Board of Directors proposes that the dividend be raised by 20 percent to SEK 4.50 per share. Interest per CPN would thus be SEK 5.18.

- The value of the portfolio of listed stocks on December 31, 1997, was SEK 28,682 M (17,752). Adjusted for purchases and sales, the portfolio's value rose 30 percent (36) from the beginning of the year. The General Index rose 25 percent (38). The total return for the portfolio was 33 percent (40).

- Net asset value at year-end was SEK 149 (114) per share and CPN, entailing an increase of 31 percent (37) from the beginning of the year.

- The price of Industrivärden's Class A stock rose 43 percent for the year, compared with a 25 percent rise in the General Index. The total return for Industrivärden's stock was 48 percent, compared with 28 percent for the Findata total return index.

- Sandvik is a new core holding following a stock acquisition worth just over SEK 4 billion.

- The subsidiaries Thorsman and Fundament were sold for a total capital gain of SEK 1,598 M.

- Consolidated earnings after financial items were SEK 2,404 M (1,417). Of this total, gains on sales of stocks accounted for SEK 1,865 M (687), dividends from listed stocks for SEK 426 M (490), and other earnings for SEK 113 M (240).

- The Board proposes that the dividend per share be increased by SEK 0.50 to SEK 3.75. Interest per CPN would thus be SEK 4.31.

- The Board of Directors also proposes a stock split, with four new shares being issued for each existing share held, and four new CPNs for each existing CPN held.

- Consolidated earning after financial items totaled SEK 1,417 M (1,765). Gains on sales of stocks accounted for SEK 687 M (1,281) of this total.

- The stockholding in PLM was reduced from 45 percent to 23 percent in accordance with previously announced intentions. The sale yielded a capital gain of SEK 508 M.

- The wholly owned subsidiary Elitfönster merged with Myresjöfönster, a Skanska subsidiary, at the beginning of the year. Industrivärden sold its stockholding at the end of the year. Earnings after financial items, but before gains on sales of stocks and nonrecurring items, totaled SEK 738 M (484).

- The value of the portfolio of listed stocks on December 31, 1996, was SEK 17,752 M (13,775). Adjusted for purchases and sales, the portfolio's value rose 36 percent (20) from the beginning of the year. The General Index rose 38 percent (18).

- Net asset at year-end was estimated at SEK 114 (83) per share and CPN.

- The holding company discount, i.e., the difference between the Company's net asset and its stock price, decreased from 38 percent at the beginning of the year to 31 percent at year-end.

- Industrivärden's stock price gained 51 percent for the year, compared with a 38 percent rise in the General Index.

- The Board of Directors proposes that the dividend be raised by SEK 0:50 to SEK 3:25 per share. Interest per CPN would thus be SEK 3:74.

- Consolidated earnings after financial items amounted to SEK 1,765 M (1,517).

- Earnings after financial items, but before gains on sales of stocks and nonrecurring items, totaled SEK 484 M (1994: SEK 775 M, including SEK 382 M from PLM).

- Industrivärden's stockholders and holders of CPNs were offered in October to purchase 55 percent of the shares in PLM for a price corresponding to SEK 3,200 M for the entire company. This entailed a discount of over 20 percent in relation to the market value in connection with the stock market introduction. PLM became listed on the Stockholm Stock Exchange in November 1995. The sale of 55 percent of the shares in PLM generated a capital gain of SEK 1,195 M.

- The value of the portfolio of listed stocks on December 31, 1995, was SEK 13,775 M (9,487), of which PLM accounted for SEK 1,839 M. Adjusted for purchases and sales, the portfolio's value rose 20 percent (-7) compared with the beginning of the year. The General Index rose by 18 percent (5).

- Net asset at year-end was estimated at SEK 83 (79) per share and CPN.

- The Board of Directors proposes that the dividend be raised by SEK 0:25 to SEK 2:75 per share. Interest per CPN would thus be SEK 3:16. As an extra dividend for 1995, each share or CPN held entitled its holder to one purchase right for stock in PLM, worth an average of SEK 2:98 each.

- Consolidated earnings after financial items, but before gains on sales of stocks and other nonrecurring items, totaled SEK 775 M (366).

- Including gains on sales of stocks and other nonrecurring items, totaling SEK 742 M (498), earnings after financial items amounted to SEK 1,517 M (864).

- The value of the portfolio of listed stocks on December 31, 1994, was SEK 9,487 M (10,048). Adjusted for purchases and sales, the portfolio's value fell by 7 percent (+66) compared with the beginning of the year. The General Index rose by 5 percent (54).

- PLM's earnings after financial items, including the SEK 202 M profit from the sale of the Food Can Division, totaled SEK 584 M (82).

- Inductus' earnings after financial items, including SEK 31 M (14) in nonrecurring items, amounted to SEK 327 M (297).

- Indutrade's earnings after financial items improved by SEK 57 M to SEK 118 M, including a profit of SEK 30 M on the sale of an agency.

- Fundament's earnings before depreciation totaled SEK 89 M (94) and after financial items SEK 54 M (51). The real estate holdings - as in the previous year - were valued in accordance with a direct yield requirement of 8 percent, which provided a real estate value of SEK 1,100 M (1,100).

- Net asset at year-end was estimated at SEK 79 (75) per share and CPN.

- The Board of Directors proposes that the dividend be increased by SEK 0:25 to SEK 2:50 per share. Interest per CPN would thus be SEK 2:88.