Share development

Industrivärden’s Class A and C shares are listed on the Stockholm Stock Exchange (Nasdaq Stockholm), Large Cap segment.

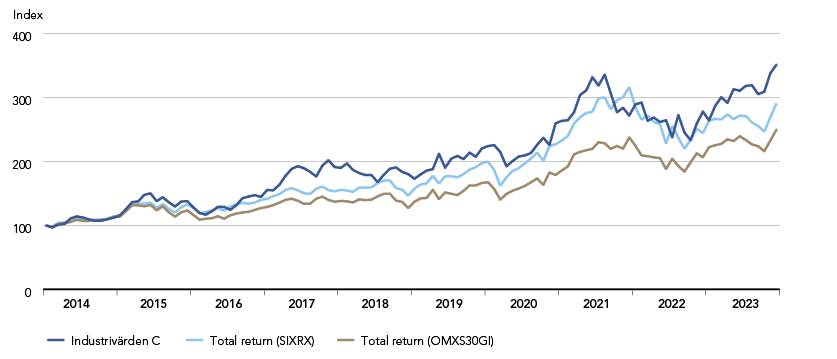

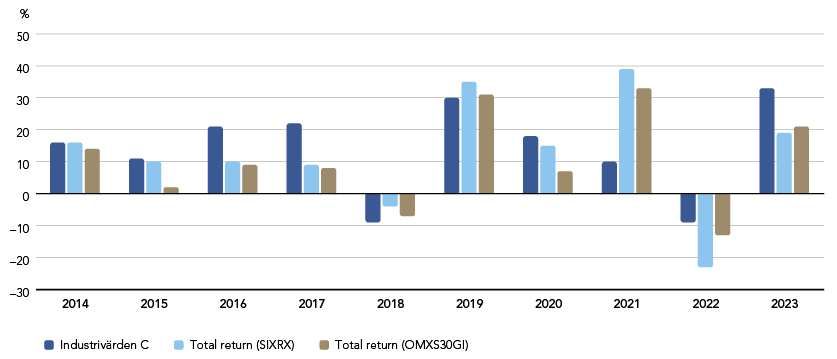

During the last ten-year period the average annual total return was 12% for Industrivärden’s Class A shares and 13% for the Class C shares, compared with a total return of 11% for the Stockholm Stock Exchange (SIXRX) and a total return of 10% for OMXS30 (OMXS30GI).

Total return over time

Total return per calendar year

Distinguished portfolio companies

Exposure to quality companies that are characterized by proven business models, a wide breadth of underlying business areas, strong market positions, good cash flows, financial strength and clear capacity for development.

Engaged owners

With a foundation in strong positions of influence, substantial knowledge about the portfolio companies and their business environments, a long-term perspective and financial strength, Industrivärden actively contributes to the portfolio companies’ governance and strategic development. The long-term ownership perspective entails a natural focus on sustainable development and long-term value creation in the portfolio companies.

Attractive return at balanced risk

The portfolio companies’ capabilities and characteristics, combined with Industrivärden’s long-term ownership involvement, enable an attractive return at balanced risk.