Share structure

Value and trading volume

Trading volume in Industrivärden shares on the Stockholm Stock Exchange in 2023 totaled SEK 42 billion (57), corresponding to a turnover rate of 18% for the Class A shares (35%) and 58% for the Class C shares (78%). Average daily trading volume was approximately 185,000 Class A shares and approximately 398,000 Class C shares.

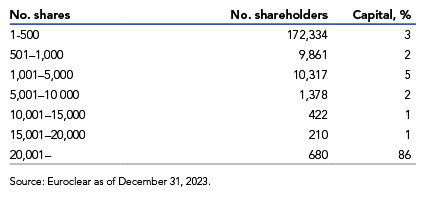

Share and shareholder structure

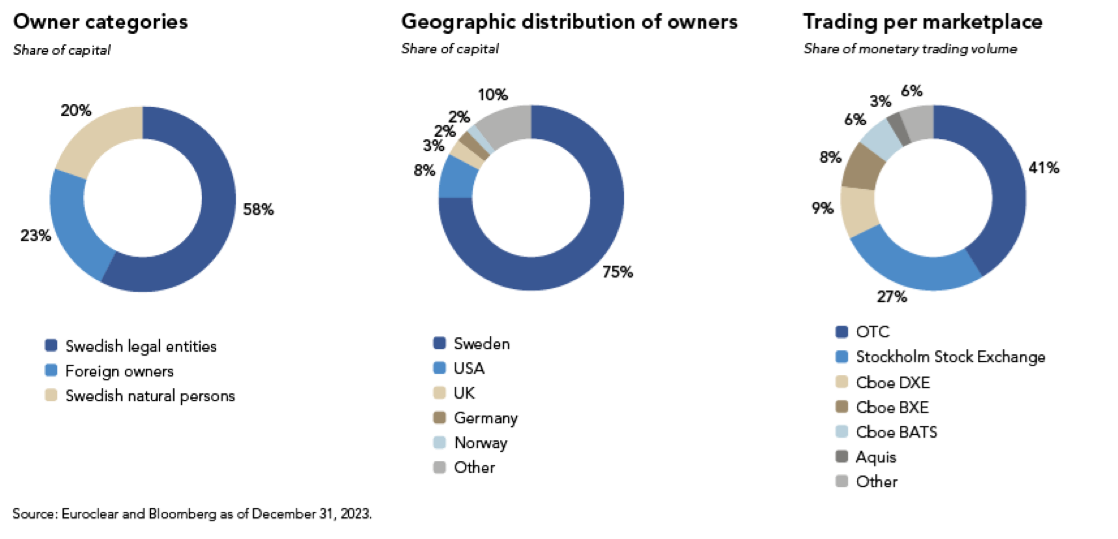

Industrivärden had approximately 196,000 shareholders (197,000) at year-end.

A significant majority of shareholders are private individuals, while a significant share of the capital is owned by institutional investors such as pension and asset management companies, and foundations. Foreign shareholders own 23% (24%) of the capital.

At year-end 2023 the share capital totaled SEK 1,088 M, distributed among 431,899,108 registered shares with a share quota value of SEK 2.52. Each Class A share carries entitlement to one vote, and each Class C share carries entitlement to 1/10 of a vote. All shares carry equal entitlement to the Company’s assets, earnings and dividends.

Return

Since Industrivärden’s introduction on the stock market in 1945, the Class A shares have generated a total return of approximately 2,700,000%, compared with approximately 1,200,000% for the total return index (SIXRX).

Industrivärden’s Class A and C shares had standard deviations of 10.6% and 10.1%, respectively, and beta values of 0.92% and 0.91%, respectively, for the full year 2023, compared with the total return index (SIXRX).

Share structure on March 28, 2024

Share class |

No. of shares |

No. of votes |

Capital, % |

Votes, % |

| A (1 vote) | 247,778,255 | 247,778,255.0 | 57.4 | 93.1 |

| C (1/10 vote) | 184,120,853 | 18,412,085.3 | 42.6 | 6.9 |

| Total | 431,899,108 | 266,190,340.3 | 100.0 | 100.0 |

Employee ownership

Industrivärden encourages its employees to make private investments in Industrivärden shares, as this aligns the interests of the Company’s employees with other shareholders. The long-term incentive programs adopted by the Annual General Meeting make up part of employees’ total compensation and aim to increase employees’ ownership of stock in the Company.

Shareholder structure